Many critics of sustainable investing, and by proxy those who use ESG analysis, argue that proper implementation consists of an all-or-nothing approach, and therefore cannot be completely effective. This is where the argument that ESG analysis is “non-pecuniary” originates. However, experts in the field agree this logic is misguided.

The trouble for many advisers is that success for a sustainable portfolio can be difficult to measure since it is assumed that values and impact cannot be quantified. If this is what is holding advisers back from embracing sustainable investing, I strongly encourage them to use ESG integration as a suitable entry point.

While some will say that the ESG integration strategy doesn’t go far enough, it is worth remembering that Wall Street has yet to discover a way to tie strings of virtue money, so an investor’s overall personal “goodness” is not, and cannot, be reflected in an investing strategy. Unless of course, they want it to.

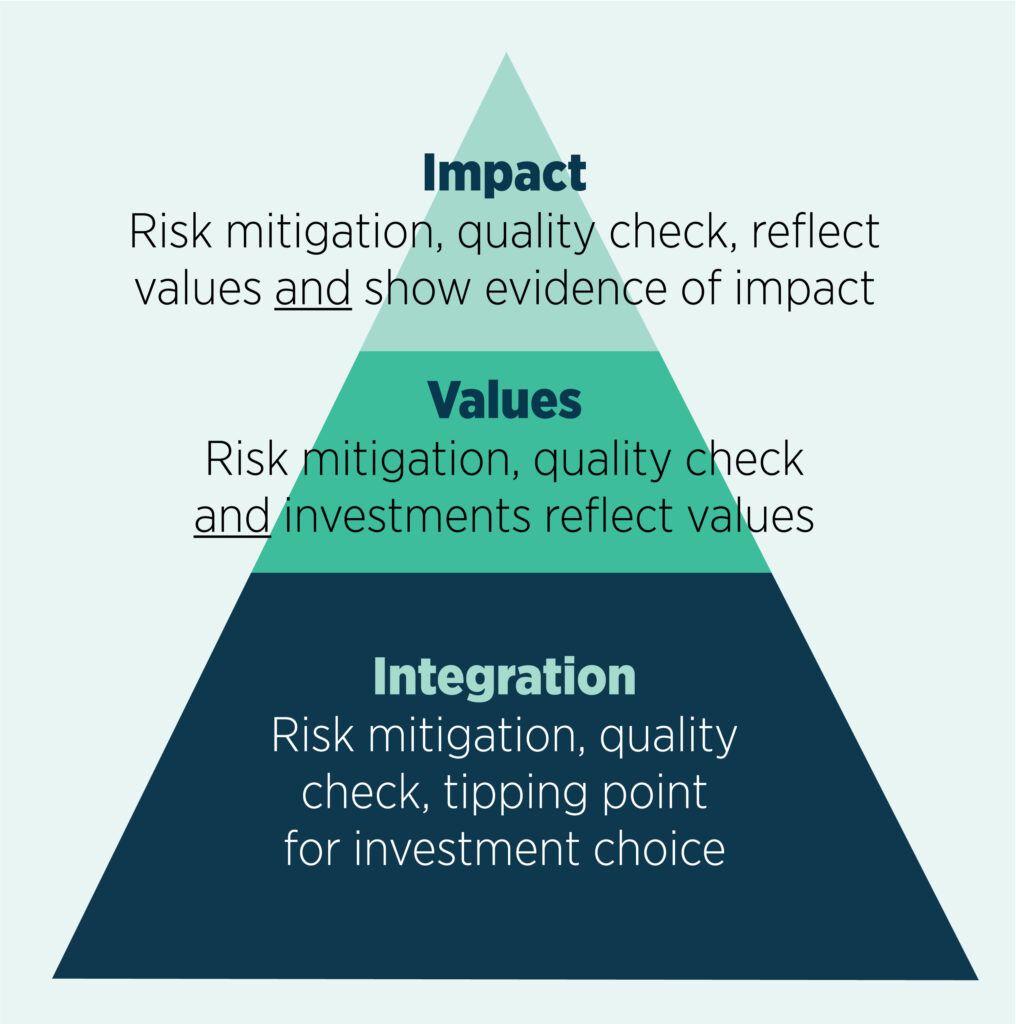

Sustainable investing means different things to different investors and there is nothing wrong with compartmentalizing these investors, in fact it makes the whole process of working with them a lot easier. Hence the creation of the hierarchy of sustainable investors: a pyramid consisting of three levels of investment motivations, with each level building upon the previous one.

The definition of sustainable investing, regardless of what strategy is used, begins with the same prefix: “An investment strategy that uses a combination of ESG criteria in order to maximize financial returns, and minimizes risk…” and depending on the investors’ reason for coming to the table, the definition gets added to.

At its root, a sustainable investing strategy is just that – an investing strategy. No investing strategy aims to lose money, so it makes no sense to imply that sustainable investing does. As one moves up the hierarchy of sustainable investors, each level is aiming to add something more to the previous level. Therefore it is important to remember that sustainable investing is always “and,” never “or.” If anything is being taken away or eliminated – other than risk – then you’re doing it wrong.

Integration

Unsurprisingly, the use of ESG integration is the most commonly used sustainable investing strategy in the US because it is the easiest to implement. At this level, nothing has been changed about the original investment analysis; the only difference is there is now an extra layer focused on financially material ESG factors.

The goal of integration is to maximize returns while minimizing material risks, which are completely different depending on the industry. The Sustainable Accounting Standards Board has refined material risk factors for corporate finance in 11 sectors and 77 industries as one of the most comprehensive ways to standardize important ESG risks, so this is a great place to start.

However, in a world that has no universal definition for what constitutes ESG criteria, simple implementation can open the door for greenwashing – either intentionally or unintentionally – so it is important to remember that ESG integration has not yet reached maturity.

Values

At the values stage, we consider all of the pecuniary factors outlined in the integration stage, and we allow for investors to provide their own considerations in the selection of investments. From a universe of categorically strong ESG-screened investments, the individual investor (or enterprise) can decide to include or exclude investments based on their own values, morals, beliefs, or preferences. This is why the integration stage is so key before overlapping one’s values: it ensures that only quality investments will be able to clear the bar for a values-based investor to choose.

Impact

For the small, yet growing, group of investors who want to see evidence of how their money is directly influencing environmental and social matters, there is the “impact” stage. In addition to the factors from all other levels, these investors seek impact reporting and shareholder advocacy to make direct, meaningful changes with their investments. Advocates of sustainable investing would love to see more investors reach this pinnacle of the pyramid, but to get here requires passing through all prior levels.

All investors at all levels of this pyramid matter: even if impact is not the ultimate goal, encouraging companies to be sustainable, conscientious, and ethical can only help minimize market risk and volatility. In the grand scheme of things, it should not matter what motives brought sustainable investors to the party. What matters is that they showed up.