A majority of global investment funds are not aligned with the goals of the Paris Agreement, with only a small percentage (1.5%) aligned with a 1.5ºC scenario, according to research from sustainability technology platform Clarity AI.

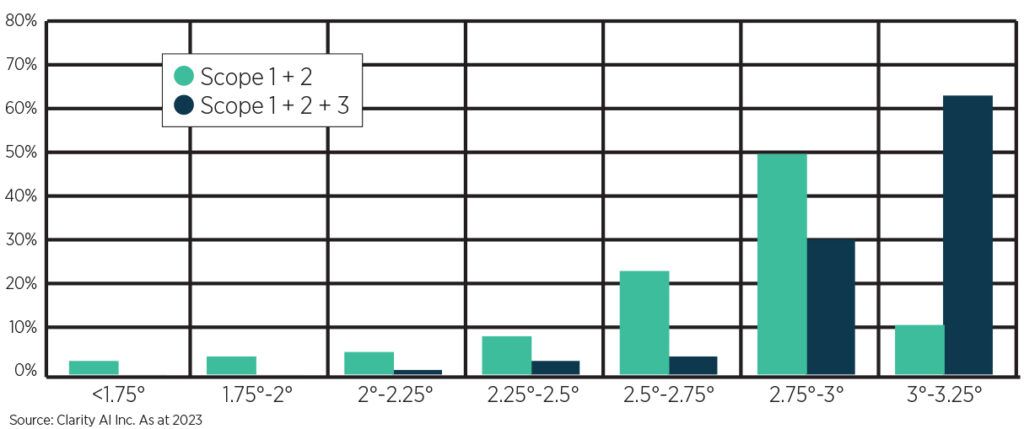

When weighted for asset allocation, Clarity AI’s analysis shows that less than 1,000 funds (1.3% of the total assets under management) are Paris aligned, based on the targets of investee companies, and more than 70% of all assets exposed are invested in funds with above 2.3ºC alignment.

Additionally, when Scope 3 emissions are considered in the analysis, less than 0.1% of assets are Paris aligned and more than 85% of assets are above 2.3ºC based on the targets of funds’ investee companies.

“Addressing the misalignment of investment funds with the goals of the Paris Agreement requires continued efforts from both the financial industry and companies across sectors,” said Pablo Diaz-Varela Pena, researcher at Clarity AI.

“Increasing the number of companies setting ambitious targets and actively working towards reducing emissions is vital for achieving a sustainable and resilient global economy.”

Percentage of AUM in global funds at different temperature alignments

By leveraging the Carbon Disclosure Project’s (CDP) environmental disclosure platform, Clarity AI conducted a global warming alignment analysis of more than 23,000 funds, totalling more than $25trn in assets.

To assess their temperature alignment, implied temperature rise (ITR) metrics from CDP were used based on the public CDP-WWF Temperature Ratings methodology. These ITRs are based on an assessment of corporate emission reduction targets, which does not measure actual alignment but alignment of ambition.

For all companies without disclosed targets or insufficient disclosures of past GHG emissions, a default temperature score was applied.

CDP published a similar analysis in October 2021, showing, at the time, that more than 90% of assets were aligned to above 2.3ºC when Scope 1 and 2 are accounted for, and more than 95% including Scope 3 emissions, highlighting that, while improvement has occurred, it is from a very low base.

For the underlying companies within the 13,044 funds analysed when comparing 2021 and 2023 data, 30% of companies have set a more ambitious target and therefore reduced their ITR, while 51% continue to not have an ambition to be below 3ºC.

While there has been some progress in average temperature alignment, Clarity AI said that their analysis highlights that globally, companies still have a long way to go to achieve Paris alignment. Furthermore, these targets are based on mid-term ambitions for emissions reduction and do not guarantee successful fulfilment by organisations.