In this new series for ESG Clarity Asia, we’ll be exploring the opportunities and challenges for sustainable fund selectors in each country in Asia and highlighting the regulation and policy that could affect them.

Changes sustainable fund selectors should know about

In December last year parliament passed the ECA Amendment Bill with the aim of facilitating the creation of the Indian carbon market. According to Xynteo’s senior partner Vipul Kumar this will act to incentivise in-country companies to invest in low-carbon projects and contribute to India’s nationally determined contributions.

Meanwhile, changes from the Securities and Exchange Board of India should enable better data-led investment decision-making, added Kumar, with the top 150 publicly listed firms to report GHG emissions according to newly drafted BRSR format from March 2024 (expanding to top 1,000 in three-years’ time).

These changes include the creation of a set of sub-categories for mutual funds interested in investing in ESG initiatives, which were released in July.

Also in July India’s government issued a consultation for a new green credit programme, which is designed to incentivise environmental friendly activities such as planting trees and conserving water usage.

Sustainable investment opportunities in India

Overall, the Indian economy is undergoing a paradigm shift: from informal to formal, from cash to digital, and from import-based to domestic manufacturing, Manulife Investment Management senior portfolio manager Rana Gupta and India equities research director Koushik Pal said in an update recently.

Meanwhile, India is upgrading its physical and digital infrastructure and focusing on the energy transition to reduce fossil fuel dependency. Reducing fossil fuel dependency should unleash opportunities in energy transition, lowering the oil import bill and further boosting the country’s macro stability, they added.

India has traditionally relied on fossil fuels, most of which are imported, but has been looking towards renewable energy. To expand the country’s green-energy capacity, the government has set an target of installing 596 gigawatts (GW) of renewable energy by 2032 – more than three times the current installed capacity of 176 GW2 (Chart 17). Thus, the share of green-energy generation is expected to almost double from approximately 23% at present to 44%.

This may bring investment opportunities in manufacturing and installation (Manulife predicts this to be to the tune of upwards of US$200bn), as well as in power transmission and distribution. Electric vehicles are another growing area of opportunity.

Manulife also sees investment opportunities in the utilities space, where the companies are redirecting cash from existing operations towards solar, wind, hydro power, and green hydrogen projects.

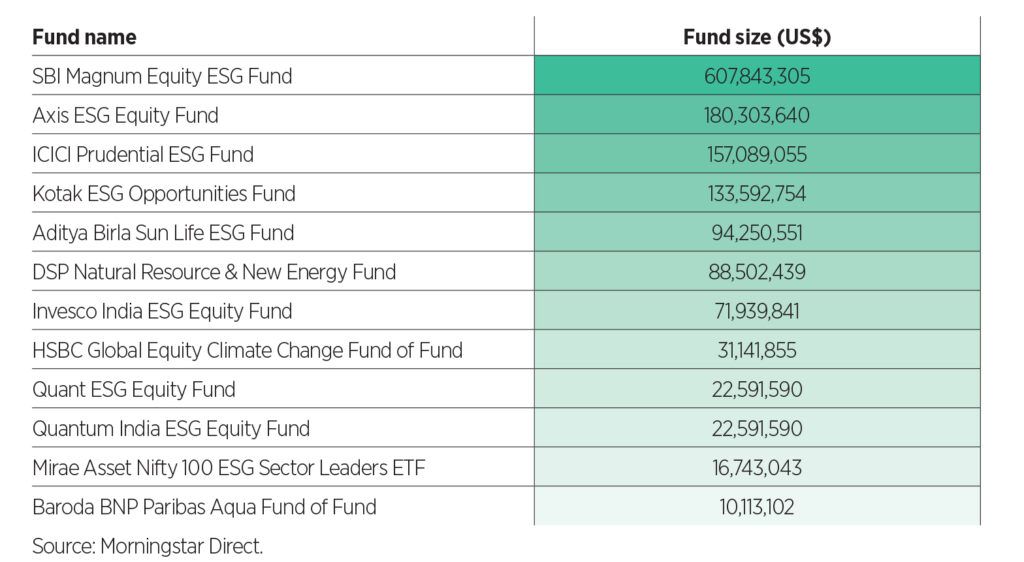

Sustainable funds available in India

Challenges for sustainable investors

“We notice investors’ reluctance to participate in the utilities sector, as a significant part of these companies’ profits come from coal-fired projects,” Gupta and Pal said. “We posit that these businesses and India’s power-generation capacity mix will likely change from approximately 60:40 (fossil: renewable) to 34:66 in favour of renewables over the next 10 years.”

In August investors in the Asia Investor Group on Climate Change called for the utilities sector to increase in pace and detail in meeting its net-zero targets.

India’s dependence on imports for electric vehicle raw materials (such as lithium) may present another challenge.

“While India may now be the largest population of consumers in the world, economic opportunity is far from equal,” Arisaig co-CEO and ESG Clarity Asia Committee member recently wrote.

Female workforce participation in India is only 25%, an alarming backslide from 32% back in 1990 despite significant progress across other development indicators over the same period. This, in turn, compares highly unfavourably with global peers – including China at 62%.

Lewis added: “It is hard to imagine a scenario where productivity growth really starts to fly in India, yet women continue to be confined to the home.”