Remember pundits characterised UK inflation as being “transitory” a few years ago? So much for that. The overwhelming consensus is now that high(er) structural inflation is here to stay, along with high(er) interest rates. The immediate consequence is that stocks and bonds are more correlated, dampening the traditional “shock absorber” role that bonds have historically played in asset allocation.

At the same time, global leaders have collectively committed to build a safer, cleaner, and fairer world for our children; an ambition that will require unprecedented levels of investment.

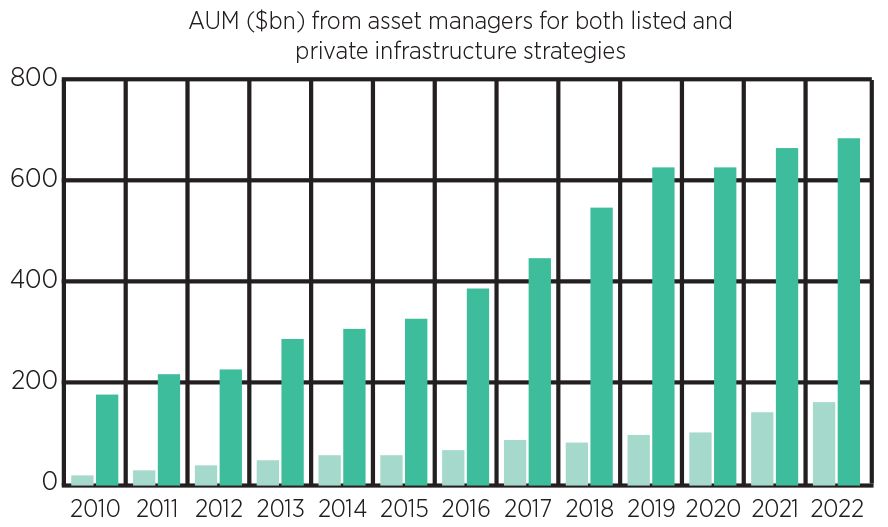

This is where ‘real’ assets – and infrastructure in particular – shine. Assets under management (AUM) for both private and listed infrastructure strategies have experienced an upward trajectory for the past decade, with listed infrastructure growing slightly faster, according to Sustainable Market Strategies.

Building a new asset class from the ground up

Is infrastructure an inflation hedge?

In today’s economic climate, infrastructure assets’ ability to act as a shield against inflation adds to its allure. On average, about 70% of revenues generated by infrastructure assets have some sort of inflation protection, but its level varies widely across subsectors.

Many infrastructure subsectors are quasi-exclusive service providers within a certain region so have strong pricing power given the inelastic demand for their services. They can pass price rises on to consumers through higher tariffs, thus maintaining steady revenue and profit margins during inflationary periods, safeguarding investor returns. Furthermore, most of these inflation-adjustment provisions are built-in either through regulation, concession agreements or contracts.

Thanks to this fairly unique feature, infrastructure investments tend to perform much better than other asset classes under higher-than-normal inflation environments and their annualised performance during times of above-average inflation was more than double the returns for US equities during the same periods.

Obviously, the asset class does not guarantee a hedge to inflation. For example, a higher rate environment disproportionately affects the renewables sector as the majority of the infrastructure project costs are front-loaded due to the fact that the “fuel” is free.

Even though utilities have stable long-term cash flows allowing them to be highly levered with long-term debt, the recent jump in long-term interest rates is changing the economics of greenfield projects. With interest rates cost forecasted to occupy a larger proportion of the expenses than predicted, some renewable energy developers and operators have delayed infrastructure projects and asked to re-negotiate previously agreed power purchase agreements.

This is essentially the first time the renewable energy sector has faced a high interest rate environment. This situation should serve as a teachable moment to structure deals that account for inflation and higher rates.

Looking ahead, there’s no scenario in which renewable energy is not a key sustainable infrastructure subsector where investment opportunities will abound. According to the International Energy Agency, annual clean energy investment worldwide will need to more than treble to around $4trn to reach net-zero emissions by 2050, the majority of which falls in the infrastructure bucket.

Pervasive impact of infrastructure on the SDGs

Using Sustainable Development Goals (SDGs) as the reference framework, researchers have found that infrastructure either directly or indirectly influence all 17 SDGs, including 121 of the 169 targets (72%). For 15 of the 17 SDGs, more than half of the targets are influenced by infrastructure, including for 5 of the 17 SDGs (SDGs 3, 6, 7, 9, and 11) for which all the targets are influenced by infrastructure.

Infrastructure assets beyond the usual suspects (renewables, water, passenger rail, health care, education) play an important role in achieving the SDGs. For example, transportation infrastructure assets such as ports and airports are crucial for the economic development and betterment of millions of people around the world. Digital assets such as towers and data centres also allow for better information and communication, which are known social and economic equalisers.

Recognising the range of infrastructure assets, including transportation and digital infrastructure, as vital contributors to the SDGs, underscores the interconnectedness of global development efforts and the need for a holistic approach to achieving these goals.