Despite the challenges of 2022 spilling over into 2023, demand for ESG products is expected to continue apace this year.

Energy stocks’ huge outperformance meant sustainable funds, with limited exposure, were left behind in performance tables and negative rhetoric around ESG grew in the US, making 2022 the year where the ESG world encountered more bumps in the road after two strong years.

This year is poised to present its own set of challenges with a looming recession and no signs of the anti-ESG stance taken across the pond going away.

However, ESG momentum across the asset and wealth management (AWM) industry appears to be intact, both in Europe and worldwide, according to PwC’s financial services market leader, Olivier Carré, and advisory partner, Frédéric Vonner.

They told ESG Clarity: “Although a recession and its attendant blows to traditional capital markets are expected in 2023, we expect ESG funds to outperform in terms of inflows, driven not least by growing investor awareness of the financial sector’s role in promoting sustainability-orientated transformations across industries.”

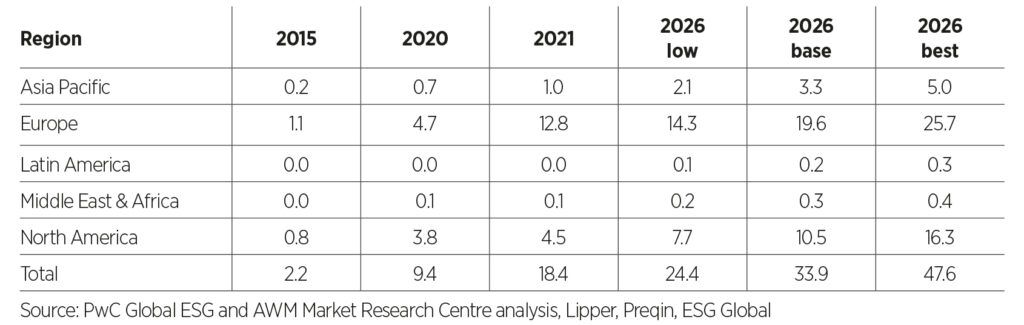

PwC data shows global ESG assets under management (AUM) stood at $18.4trn in 2032 having a compound annual growth rate (CAGR) of 42.7% since 2015. By 2026, PwC projects this number to rise to $33.9trn in a base-case scenario. Europe will lead this expansion, with its $12.8trn of ESG AUM in 2021 expected to rise to $19.6trn in 2026, at a CAGR of 12.9%.

Global ESG AUM by region ($trn)

However, they noted a number of areas that ESG product providers and users will need to be mindful of with “soon-to-be enacted rules and regulations” such as the Financial Conduct Authority’s Sustainability Disclosures Requirements (SDR) being rolled out in summer 2023.

“As disclosure requirements multiply, AWM stakeholders need to take precautions to avoid mislabelling funds and uphold investor confidence,” they warned.

Meanwhile, fund selectors have noted a number of gaps in the range of sustainable products available on the market, despite the proliferation of funds launched or repurposed in recent years.

Here, they share the products they think the market is lacking:

Absolute return and anything that can help us with SDR

Louisiana Salge, head of sustainability, EQ Investors

We are looking for anything with diversifying characteristics from existing impact equity funds, and there could also be some more sustainable options in infrastructure and real estate.

We are also looking for more absolute return products – Trium recently launched the Climate Impact Fund, a UCITS equity long/short product and we have had some very encouraging conversations with them.

Also, anything that can help us navigate the upcoming SDR.

Funds working with the big polluters

Tim Cockerill, investment director, head of responsible and values based investing, Rowan Dartington

We are missing some value-oriented ESG funds.

But also, ESG products tend to avoid the big polluting industries and we need to take a look at things in a different way. Every business has to transform, and it would be good to see funds working with them proactively to minimise their environmental impact and maximise their social impact. We can’t build a decarbonised world without raw materials.

More regional and alternatives products

Scott Spencer, investment manager within the multi-manager team, Columbia Threadneedle

When we were looking to launch sustainable fund of funds models, which we aren’t now, the hardest area to find funds to replicate, for example, our Cautious Managed mandate, was in regional equities.

If we wanted to replicate UK, North America, Asian equity funds we would have had to use global sustainable funds – there aren’t many sustainable funds purely exposed to these regions, although there were more emerging markets and European sustainable funds.

Second, there wasn’t many sustainable alternatives products that we would use as diversifiers – not many sustainable absolute return products, for example. Some would say they are but drilling down they really were low beta equity.