In the second part of our conversation with UK-based Castlefield, we talk to Olivia Bowen, partner of financial advice, about the hidden risks of tracker funds, and why a big corporate and social responsibility department doesn’t always tally with good ESG ratings.

How did you get into ESG financial planning, what was behind the decision and how long have you been practising it?

I have worked in ethical finance since I was 23, so more than 20 years. In those days, we called it “ethical investment”. Working for a company with strong values was always important to me, which is how I found my career – so, I came into it because of my ethical interests, rather than because I was specifically looking for a role in financial services. I also liked the idea of working for a relatively small company where I could have a big impact, rather than joining a large firm where it’s easier to get lost.

Have you noticed a shift in conversations about ESG recently?

Within our industry, certainly. Clients remain constant. It’s such a relief that financial services is taking responsible and thoughtful investment more seriously at last – we’ve been banging on about it for decades! So we are seeing most fund houses addressing these issues – however typically via new fund launches rather than a change of strategy across all funds.

We’ve always had a steady stream of leads, over many years, and these come from a variety of sources in terms of age and gender and geographical location. The public appetite for responsible and thoughtful investing has always been there, but our industry has in general been slow to respond.

Although I’m delighted to see retail customers’ appetite for ESG finally being met, there will be a backlash against the movement I’m sure, as those firms who have indulged in, or been careless about, greenwashing get found out.

When carrying out your investment research, what are you looking for from an ESG perspective?

We are very lucky to have an in-house investment management team on whose expertise we rely.

The foundation of our investment process is negative screening. This means that we exclude industries and sectors that are at odds with our clients’ values, such as oil and gas, tobacco and armaments.

Responsible and sustainable business practices allow companies to produce better long-term returns. So, equally important to exclusions, is a selection of positive themes we want to consider when making an investment. Some examples of these are:

Do you have any red flags for funds?

There are firms that simply introduce an ethical fund to their range in order not to be left behind, but don’t fully invest in their offering nor believe in it, but they can still score well under some ESG ratings, so I’d recommend being wary of these.

ESG ratings are evaluations of a company based on a comparative assessment of their performance on these issues.

It’s important to understand the underlying data, as they have different biases towards E, S or G, use different data and weigh the data differently. A company can have a high rating with one agency and a low rating with another. They also tend to favour companies with large corporate social responsibility (CSR) departments.

Lack of data and consistency are big problems – for example you can see an oil company scoring highly because they do well with governance, and the social and environmental impact is lost.

So, we see ethical funds that only adopt ESG ratings to select their underlying companies – which is most prevalent in tracker funds – holding oil companies. They are no substitute for investment managers applying their own analysis to ESG factors.

We hope that over time companies will provide more and better data, and rating providers will provide greater transparency and correlation.

Where are there gaps in the market in terms of ESG funds?

The market is somewhat flooded at the moment, but there’s room for more good quality ethical funds that focus on a specific geographical region or sector. These should combine negative and positive screening, alongside engagement and stewardship.

Our investment team continually engage with the companies they invest in on behalf of clients. It’s important that we understand how companies are reacting to topics that our clients care about. We also work collaboratively with other investment managers on engagement projects, which is an effective way to speak with a unified voice and enhance the influence of investors on corporations.

Examples of typical engagement points might be:

Where do you see ESG investing heading?

Greenwashing will probably always exist, but the backlash from doing it is likely to increase. I predict that the ESG industry, having expanded rapidly, will contract – and hopefully not destroy its reputation in the process. I think retail customers will always be sympathetic, but they need a strong and knowledgeable advice industry to champion investing responsibly, and to provide the advice that they desire (rather than putting them off which used to happen) so that we can future-proof their assets and help to protect them from the threats that face the global environment and society.

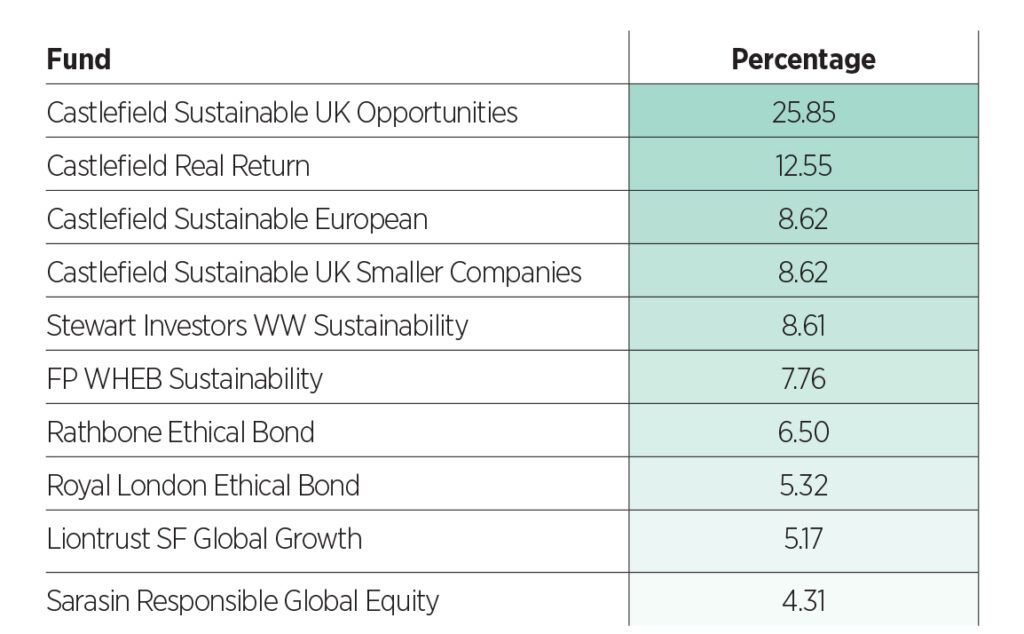

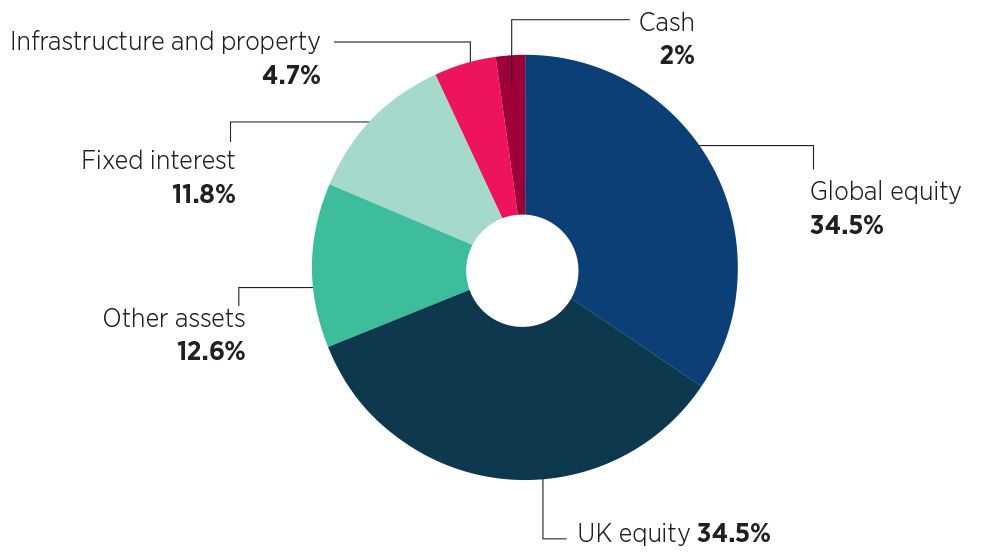

Example ethical portfolio – Medium Risk Growth Ethical Model Portfolio

| Percentage of assets under advice that are ESG | 98% |