Around 45% of the 1,200 funds currently labelled as ISR in France have energy exposure that will need to be addressed before March 2025 when more ambitious requirements come into place around the inclusion of energy stocks.

Last week, Finance Minister Bruno Le Maire announced he would support the ISR – known as socially responsible investing (SRI) in the UK – committee’s proposal to ban funds using that label from investing in companies involved in new projects related to the exploration, exploitation and refining of fossil fuels, whether conventional or unconventional. Maire said the stricter criteria was “essential” in ensuring investors understand what is held in sustainable portfolios and to tackle global warming.

See also: – French SRI standards overhaul leads to full exclusion for fossil fuel developers

Research carried out by Morningstar in the paper French ISR Label Revamp, authored by Hortense Bioy, global director of ESG research and member of the ESG Clarity EU Committee, found 45% of ISR funds will need to divest €7bn from an oil and gas companies to retain the label.

It acknowledged it is “premature to estimate the full impact” as final eligibility criteria are yet to be published (expected end of this month) and the updated framework will not take effect until 1 March 2024, with existing funds given a year to comply.

Fund exposure

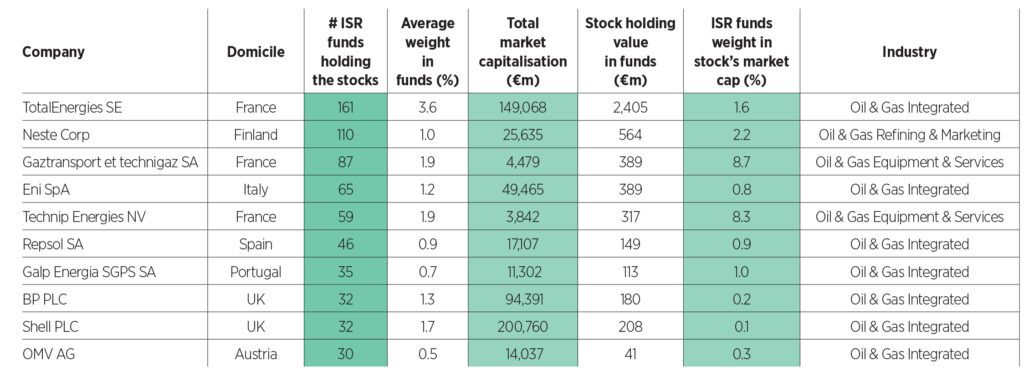

However, it flagged more than 160 ISR funds have exposure to oil giant TotalEnergies with an average weight of 3.6% within portfolios and an aggregate value of €2.4bn. To keep the ISR label beyond March 2025 these funds will likely need to shift away from this holding causing a potentially significant reshuffling of the portfolio weightings and impact on market values.

Morningstar’s research also found 110 funds had on average 1% exposure to Finnish energy company Neste, 87 funds had on average 1.9% held in German firm Gaztransport et Technigaz and 65 funds had 1.2% on average in Italy’s Eni SpA.

“While we don’t have specific information or data to share about other energy companies’ expansion plans, it is fair to assume that virtually every company focused on oil and gas exploration, production, and refining is continuously looking to expand its oil and gas activities,” Bioy said.

“Investors would be hard-pressed to find an oil and gas company that doesn’t plan to replace its declining production from old fields by developing new fields, be they on the oil side or the gas side (liquified natural gas, for example). Similarly, it can be assumed that companies in the oil and gas equipment and services business, such as Technip and Gaztransport et technigaz, are also involved in new projects related to the exploration, exploitation, and refining of fossil fuels as they enable their clients (oil and gas explorers, producers, and refiners) to develop new fields. They are part of the value chain.”

Bioy also noted that if Technip and Gaztransport et technigaz fall within the scope of the final criteria, the impact on their market values would be significant as ISR-labelled funds currently hold 8.3% and 8.7%, respectively, of the companies. However, she noted, the impact on companies such as BP and Shell would be insignificant as labelled funds representing only 0.2% and 0.1%, respectively, of their market capitalisation.

Wider fund label review

The stricter criteria for France’s ISR label comes at a time when many countries are assessing whether current fund labels and categories remain fit for purpose. The European Union has initiated a complete review of its Sustainable Financial Disclosure Regulation, which could lead to the replacement of the Article 8 and Article 9 designations with labels, while the Belgian label, Towards Sustainability, was also recently revised. In the UK, sustainable investors await the publication of the final update of the Sustainability Disclosure Requirements.

Bioy (pictured left) said: “This revamp is a significant indicator of the mood of one of the strongest ESG markets in the world. It is clear that the French government is aiming to reflect the expectations of French end investors and demonstrate their backing against further investment in fossil fuels.

“The description provided by Bruno Le Maire of the companies affected by the new exclusion rule is quite vague. We will have to wait for the publication of the final criteria at the end of the month to better understand the impact of the new rules on existing portfolios. The devil is always in the details.”