In this series for ESG Clarity Asia, Morningstar dives into ESG funds available in Asia, analysing their investments, performance and ESG credentials.

For this third article, Morningstar’s Claire Liang takes a look at the Fidelity Sustainable Asia Equity fund.

Fidelity Sustainable Asia Equity is an excellent Asia equity proposition thanks to its experienced and savvy lead manager, well-resourced analyst team and highly robust investment process.

Lead manager Dhananjay Phadnis brings 22 years of investment experience and joined Fidelity in 2004. He relocated to Singapore from Hong Kong in July 2022, which has no impact on his responsibilities, and he continues to work closely with the analyst team and assistant portfolio manager Flora Wang, who has 13 years of ESG experience and has been promoted to the firm’s head of stewardship for Asia ex Japan since September 2022. She is building up her fundamental analysis skills with the aim of becoming the strategy’s co-manager. The supporting 62-member Asia-Pacific ex-Japan analyst team is well resourced and has successfully contributed to the firm’s several Asian equity strategies.

This strategy has formally adopted a sustainability mandate since February 2021, which we consider a formalisation of the approach that Phadnis has already employed. He has stayed true to his quality growth bias even during difficult times in 2021 and 2022, when growth stocks lagged their value counterparts by a large extent. Despite suffering from stylistic headwinds, Phadnis’ prudent risk management and valuation discipline has helped buoy the strategy’s relative performance over the past two years.

The investment process starts with hard ESG exclusions and also excludes companies with “deteriorating” ESG momentum. Phadnis has long-favoured quality companies run by strong management teams and can demonstrate sustainable value creation, and focuses on a firm’s competitive advantages, management quality, potential for improvement on ESG practice, and valuations in stock selection. Then he selects 50-70 names into the end portfolio, which typically are fundamentally sound businesses trading below their intrinsic values and out-of-favour stocks with turnaround catalysts.

Sector and country allocations typically stay within 10 percentage points of the index, with active share trending between 60% and 70% over time. Phadnis will trade around positions depending on relative valuations. That said, he invests with a long-term mindset, and annual portfolio turnover has been consistently below 50% in recent years.

Phadnis has further increased the portfolio’s exposure to financials over the past year, and its 33.1% stake as of December 2022 was above the MSCI AC Asia ex Japan Index’s 21.4%. In addition to maintaining a sizeable overweight position in AIA, Phadnis added to insurance company Prudential amid its stock price weakness. At our January 2023 meeting, he cited the insurer’s great focus in Asia and believed that it is well positioned to benefit from China’s reopening.

Among banks, Phadnis continued to prefer private Indian banks over Chinese banks for their higher quality and better growth potential, and he bought ICICI Bank in Feb 2022 when its share price corrected. Meanwhile, the December 2022 portfolio’s 17% consumer discretionary stake represented a 2% overweighting against the index. Phadnis scaled up the portfolio’s weighting in Alibaba to a neutral position. While he acknowledged that the e-commerce giant continues to face intense competition from short-form video players doing livestream shopping, he was constructive on the management’s efforts in rationalising spendings and noted that the margins for its core business has stabilised.

He also initiated a position in Sands China in September 2022 as a recovery play. He liked the Macau casino operator’s exposure to the mass gaming segment, which he believed will benefit the most from a resurgence of tourists following China’s easing pandemic travel restrictions.

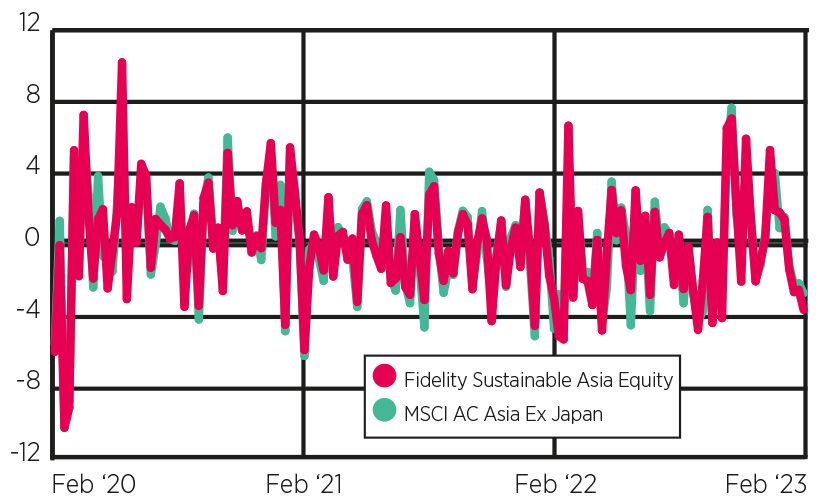

Fund performance over three years