Green hydrogen is a critical piece in the carbon-reduction puzzle. In addition to having an essential role in reducing greenhouse gases, it also has investment potential.

Hydrogen is already produced in relatively large quantities. About half is consumed in ammonia fertilizer production, while another quarter goes to petrochemical refining. Most of the remaining capacity is directed to industrial applications.

There are three types of hydrogen: green, blue and grey. Most are produced using fossil fuels like natural gas or coal. The production process for what’s known as grey hydrogen releases harmful carbon emissions into the atmosphere. Blue hydrogen production employs a similar process, but the harmful carbon emissions are captured and stored, keeping them out of the atmosphere.

See also: – Green hydrogen becoming more attractive as costs fall

By contrast, green hydrogen production employs electrolysis. This process separates hydrogen and oxygen molecules by applying green electricity from renewable sources to water. The resulting product is genuinely carbon-free. So, it is renewable with minimal environmental impact.

Newer and greener uses for hydrogen include:

Industrial heat source

The steel and cement industries are responsible for approximately 16% of the world’s carbon dioxide emissions, according to a 2021 World Steel Association report. Hydrogen has the potential to replace the fossil fuels typically burned by these industries, reducing or eliminating the associated greenhouse gases.

Heavy duty transportation

According to the Environmental Protection Agency, the transportation sector is responsible for 29% of US greenhouse gas emissions. Therefore, trucks, buses and trains are chief targets for reduced emissions. Hydrogen fuel cell technology is well-suited for these applications because the refueling interval and travel range are comparable to current gasoline- or diesel-powered vehicles.

Electricity production

Hydrogen can be stored as either a gas or a liquid. Stored hydrogen burns like natural gas without carbon dioxide emissions.

Florida-based NextEra Energy, for example, is converting its Okeechobee Clean Energy Center from running only on natural gas to a combination of natural gas and hydrogen. Its nearby solar and wind infrastructure provides the energy to produce green hydrogen stored for later use.

Green hydrogen production and climate change

While hydrogen has exciting potential, its production method is critical in determining the actual impacts on greenhouse gas emissions. For hydrogen to contribute to decarbonization goals, a transition to cleaner production methods is required.

Green hydrogen’s challenges

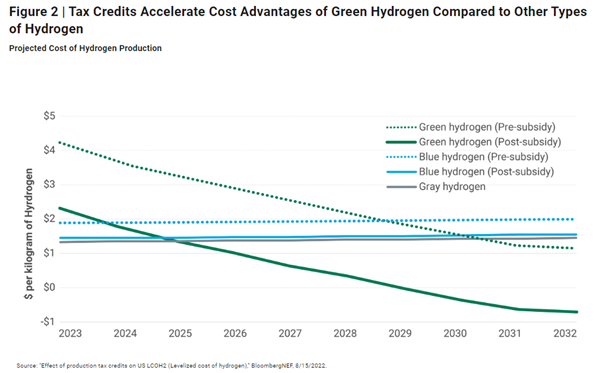

Although green hydrogen has long been considered a solution for reducing greenhouse gases, progress to make the technology economically feasible has been slow. According to BloombergNEF, green hydrogen costs up to $5 per kilogram to produce. This is considerably more expensive than the production cost of roughly $2 per kilogram for blue hydrogen and $1.50 per kilogram for grey hydrogen.

The cost of renewable electricity for green hydrogen production continues to decline. We also expect greater production volume and improved efficiency to lower prices for the electrolyzers that separate the hydrogen and oxygen molecules. Combined, these factors could make green hydrogen competitive with fossil fuel equivalents in the coming years.

The recently passed Inflation Reduction Act further supports green hydrogen in the US by providing up to $3 per kilogram in tax credits. This credit will make green hydrogen immediately cost-competitive in many parts of the country and the most inexpensive method of production by mid-decade.

Investment opportunities

Hydrogen as an investment theme may present attractive long-term growth opportunities across various industries.

Hydrogen has evolved from being part of the production process for ammonia and fertilizer to a store of energy for industries such as transportation and utilities. Established industrial gas companies, such as Air Products and Linde, have deep global experience in hydrogen generation and distribution and transportation networks.

As demand for green hydrogen accelerates, makers of electrolyzers to produce the hydrogen and fuel cells to convert it to electricity could enjoy robust growth for many years.

Accelerating green hydrogen production requires significantly more renewable energy generation. Leading developers such as NextEra Energy and AES may experience strong demand for their solar and wind installations.

Hydrogen can play a unique role in heavy transportation and industrial processes. Advancements in electrolyzer technology and greater efficiencies support hydrogen development. The falling costs for solar and wind and government subsidies will also contribute to the accelerated adoption of green hydrogen.

Investing in themes involves risk and the potential for volatility. That’s certainly true for investments in an evolving technology like green hydrogen. Over the long term, however, innovative companies supporting green hydrogen may offer attractive investment potential.