There remains a stark geographical disconnect between where most climate change portfolio investment is directed (the US and Europe), and the main source of incremental emissions (Asia), as well as the location of the population most impacted by climate change (emerging markets).

BloombergNEF found that in 2020, developed countries had 12 times more investment per MtCO2e emissions from the energy sector than emerging markets. This gap has been widening since 2015.

Homegrown solutions are imperative to this transition in developing countries, since it is unlikely that a reliance on ‘technological aid’ drifting towards the Global South can trigger change with anything like sufficient urgency.

It is clear that the scale of economic transformation required to adapt to climate change brings with it the potential for vast rewards, as well as being arguably the most high-impact destination for capital deployment in modern human history.

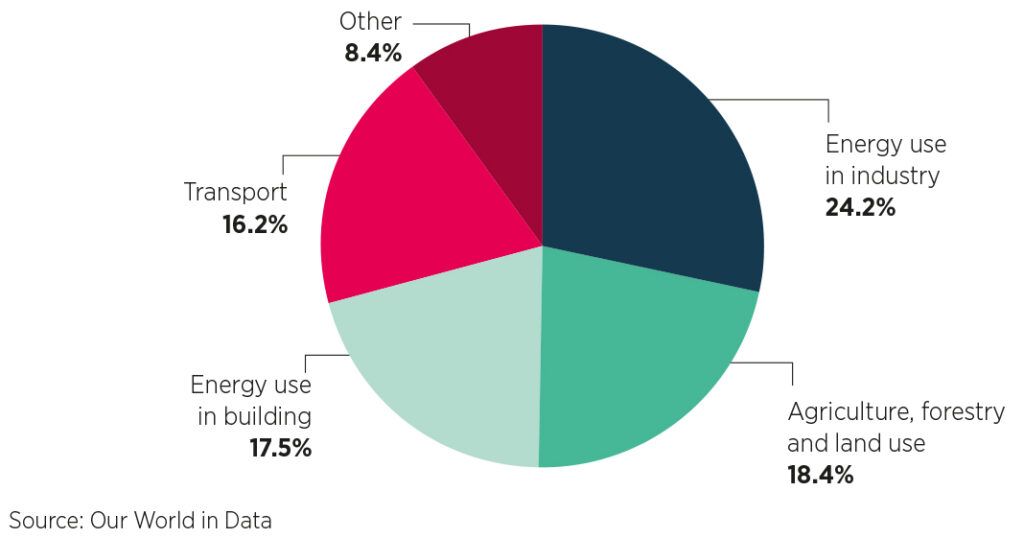

With ‘impact at scale’ in mind, it makes logical sense to focus on the greatest sectoral contributors to global emissions with roughly 90% (84.7%) from namely energy generation (for industry and buildings), mobility, and agriculture and food.

Sector opportunities

Within energy generation, the good news is that solar and wind power already make obvious economic sense in the emerging world’s major population centres. The most recent International Energy Agency data on levelised cost of electricity suggests that solar energy and onshore wind remain the most cost-efficient sources of incremental electricity generation capacity in China and India.

Although global wind turbines manufacturing footprint is somewhat more Westernised, China produces the panels and components that make this expansion of solar energy capacity possible on a global scale. This is an industry that carries ESG risk (principally in labour rights and use of coal power) but which is high-growth, fundamental to global climate change transition, and consolidating around a few increasingly stable, established pioneers who can reinvest the proceeds of their scale in eking out additional production efficiencies and solar panel effectiveness.

Within the ‘mobility’ category for most developing countries, the most effective climate change mobility solution is encouraging dense population centres built around a system of walking, cycling and public transportation. Complementing this there are encouraging developments in electrified transportation, which are tailored to an urban emerging market environment, such as affordable electric scooters and ‘swappable’ batteries. Where established road infrastructure is already in place in China, the opportunity is huge, but investors will likely face challenges of irrational pricing due to vast overcapacity built up in this space.

We are perhaps most energised by the potential for transformative solutions in the agriculture sector. Developing countries face the challenge of enhancing their own food security alongside inevitable structural decline in yields because of the changing climate.

There is immense potential for biotechnology address this. More efficient agriculture also brings with it a reduction in the resource footprint of existing producers. One business we own offers both targeted, biological alternatives to the conventional blanketing of fields with fertiliser and insecticide chemicals; as well as drought-tolerant GMO variants of core staple crops. We expect significant further listing activity in this space in China and India, which both have more than a billion mouths to feed domestically.

Climate change in emerging markets is where the world’s biggest problem meets the world’s largest populations – companies and investors that provide genuine, scalable, and sustainable solutions will be amply rewarded.