Nearly half of UK investment firms have no plans to capture data among their staff about neurodiversity and caring responsibilities, findings from an Investment Association report show.

The Investment Association, alongside WTW’s Thinking Ahead Institute, has published an industry-wide data report on equity, diversity and inclusion (EDI) data in the UK investment management industry based on questionnaire responses from 52 UK investment and fund management firms, interviews and other sourced data.

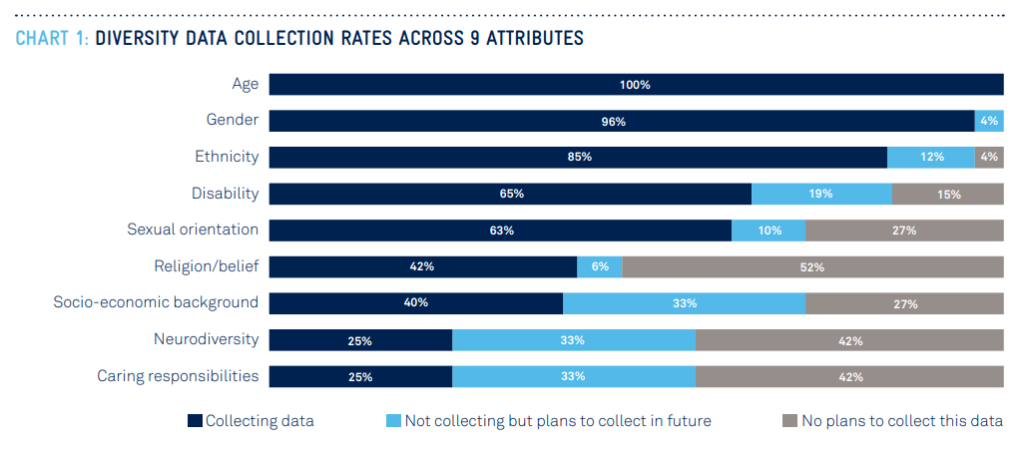

The EDI Data Survey found neurodiversity and caring responsibilities were the least collected data among firms, with just 25% collecting data on them, and 42% of firms having no plans to collect data in either area.

Source: EDI Data Study, Investment Association and Thinking Ahead Institute, Nov 23

Neurodiversity

Neurodiversity is an umbrella term covering a number of neurodevelopmental conditions, including attention deficit hyperactivity disorder, autism, dyslexia, dyspraxia (challenges with movement, sequencing and direction), and dyscalculia (difficulty with numbers, including money and time).

“While there has been an increase in the number of people being diagnosed with neurodiversity in the last few years, there are several potential reasons for low employee declaration,” the report said.

“Alongside people choosing not to disclose out of fear of discrimination, neurodiversity diagnosis can be difficult to obtain with demand-capacity gaps for diagnostic assessments, particularly for adults.”

Last year neurodiversity consultant Rachel Morgan-Trimmer told ESG Clarity neurodiversity was “the next big thing” in EDI.

“Neurodiverse people form the only marginalised group that is skills-based, yet nine out of 10 companies still don’t have neurodiversity on their agendas. Not only are they missing out on talent, and losing out to their more inclusive competition, they’re also at risk of litigation,” she said.

Despite unwillingness to collect neurodiversity data, the EDI data report said more than half (53%) of firms are implementing “support measures”. Various measures – such as employee resource groups and networks, and working with industry initiatives – were found across the board, but the report did not outline any hard and fast EDI policies at firms.

Religion and caring responsibilities

Although nearly half of firms surveyed (42%) were collecting data on religion, this was also the area in which most firms (52%) had no plans to collect data. At firms that did collect data on caring responsibilities and religion the response rate was high.

“Data is the backbone of creating and implementing an effective EDI strategy,” said Karis Stander, director of culture, talent and inclusion at the Investment Association.

“It offers the best possible opportunity to drive change by informing allocation of resources, evaluating the success of initiatives and progressing current and future diversity and inclusion plans.”

Marisa Hall, head of the Thinking Ahead Institute, added: “Unlocking industry progress in equity, diversity and inclusion means measuring more than we currently do.”