The transition to a low-carbon economy may potentially have wider – and more profitable –implications for investors than many people realise.

As various technology, policy and societal preferences reshape and accelerate the shift to a lower carbon economy, the role of raw materials and other components required to create the necessary infrastructure and clean energy should not be overlooked.

Critical minerals are an example of this opportunity. To meet the demand for renewable power, electric vehicles (EVs) and battery storage, for example, the required amounts of copper, rare earth elements, aluminum, lithium and cobalt is estimated to at least double by 2040[1]. More broadly, an average of US$2.2 trillion has already been invested annually in the energy system over the past decade[2], according to the International Energy Agency (IEA). This is now estimated to grow to US$4 trillion average annual spend through 2050[3].

At the same time, while materials like cement and steel seem to contribute to the problem of greenhouse gas emissions, these same companies are also critical to the solution. Put simply, wind turbines, solar panels and EVs wouldn’t exist without minerals like copper and lithium to help build them.

With this in mind, BlackRock’s Evy Hambro, global head thematic and sector investing, and Olivia Markham, portfolio manager, thematic and sectors team, answer key questions on why “greening” traditionally “brown” industries is an increasingly compelling investment case.

What is the role of materials as part of the low-carbon transition?

At BlackRock, we define transition investing as: “Investing with a focus on preparing for, being aligned to, benefitting from and/or contributing to the transition to a low-carbon economy.” Materials are key ingredients to this evolution.

These companies supply the materials required to build lower carbon technologies, whilst simultaneously focusing on reducing their own emissions intensities.

Within the sector, we see companies that are high carbon emitters today developing what we see as credible[4] plans to reduce their emissions intensity over time – with actions such as switching from diesel to electric mining trucks or adopting lower carbon steel furnaces.

So is it a myth that low-carbon economies will be led solely by renewables, EVs, and recycling?

We see clean energy as only one piece of the low-carbon puzzle. In addition, there are three broad groups of materials-related businesses that, together, form the Brown to Green Materials theme.

- Emission reducers – companies with credible[5] plans to reduce emissions intensity over a planned period.

- Enablers – businesses that either supply materials required for lower-carbon technologies or enable materials companies to reduce their emissions.

- Green leaders – firms which are leading in their sub-industry in terms of producing lower-emission materials.

Why are these types of materials companies of potential interest to investors?

We believe this theme has the potential to deliver outperformance versus broader equity markets over the long run.

One of the alpha drivers stems from the fact that, in our view, emission reducers are expected to benefit from a re-rating as their sustainability risks decrease. In turn, with a higher multiple, they should become more valuable to own over the longer term.

Meanwhile, enablers are poised to benefit from stronger-than-expected earnings growth if the adoption of lower carbon technologies exceeds expectations. There are many examples of this with disruptive technologies – for instance, even at consensus expectations, demand for copper for EVs and renewables is expected to be around 4.8x higher in 2030 versus 2022[6].

Will this be a long-term opportunity? What happens once these materials companies are considered “green”?

In our view, as the BlackRock Thematics and Sectors team, we believe those materials businesses which drive the reduction of emissions intensity are likely to see persistent advantages as the market for low-carbon materials develops. We expect these companies to benefit from lower operational costs and reduced decarbonising capital requirements versus higher carbon peers.

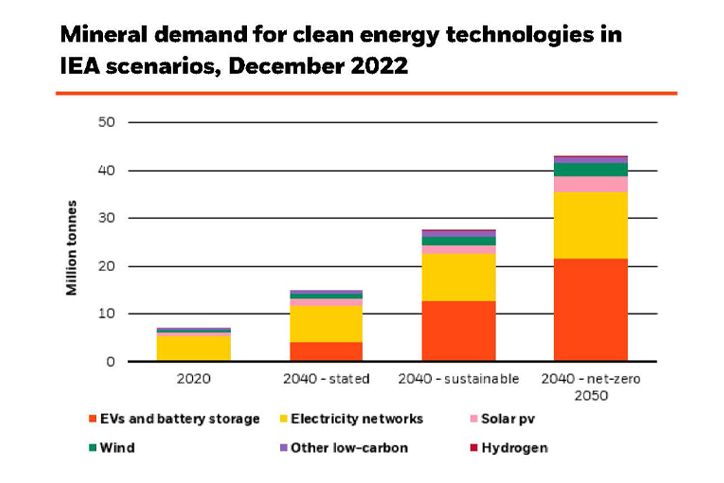

Further, the rapidly growing demand for clean energy technologies such as EVs and battery storage, electricity networks, solar photovoltaic technology, wind and hydrogen, requires millions of tonnes of minerals – anywhere from around 15 million tonnes under the IEA scenario to meet stated decarbonisation policies by 2040, to just over 40 million tonnes if the target is to reach net zero by 2050[7].

We expect to see trillions of US dollars allocated to the clean energy transition and this will create structural demand growth for the materials required over the coming decades. Based on this analysis, investors who choose to position their portfolio in line with these shifts are likely to capture a significant investment opportunity[8].

Find out more about BlackRock’s approach to sustainability and the low-carbon transition here.

[1] Source: BlackRock Investment Institute and International Energy Agency (IEA), December 2022

[2] Source: IEA, World Energy Investment 2023

[3] Source: BlackRock Investment Institute Transition Scenario, July 2023

[4] “Credible” is defined as how achievable a company’s plan is to reduce its carbon emission intensity and is determined by investment professionals on BlackRock’s Thematic and Sectors team

[5] “Credible” is defined as how achievable a company’s plan is to reduce its carbon emission intensity and is determined by investment professionals on BlackRock’s Thematic and Sectors team

[6] Source: Jefferies, 31/03/2023

[7] Source: BlackRock Investment Institute and IEA, December 2022

[8] The opinions expressed, which reflect our judgement as of the date stated, may change as subsequent conditions vary.