The number of incidents negatively affecting nature and biodiversity is rising, with industries that cause such damage lacking adequate means to manage the issue, according to the latest ESG spotlight report from Morningstar Sustainalytics, Biodiversity in the Balance: Hedging Portfolio Risks.

Investors are growing increasingly interested in addressing portfolio risks linked to biodiversity loss, and whether they are holding stocks in companies involved in land use changes as such activities “have led to operational and supply chain disruptions, reputational damage and systemic risks”, noted one of the reports authors, Martin Vezer, ESG research associate director at Morningstar Sustainalytics.

“According to our research, automobiles, food retailers, textile & apparel and household products companies have a relatively high proportion of companies involved in controversies associated with biodiversity loss through their supply chains. Our research can help investors better understand how these factors may affect global equity portfolios.”

By analysing consumer sector portfolio strategies, the research shows how ESG integration may yield upside: based on portfolio modelling, a portfolio that invested in stocks with a lower Material ESG Issue (MEI) risk score delivered a cumulative return of 51.1% over the past five years (2019 to 2023) and a Sharpe ratio of 0.48, compared to a higher MEI risk portfolio that had an 8.5% cumulative return and a Sharpe ratio of -0.04.

According to this analysis, investing in companies that are less at risk from controversy than their sector peers can coincide with strong financial performance.

Increasing risk to portfolios

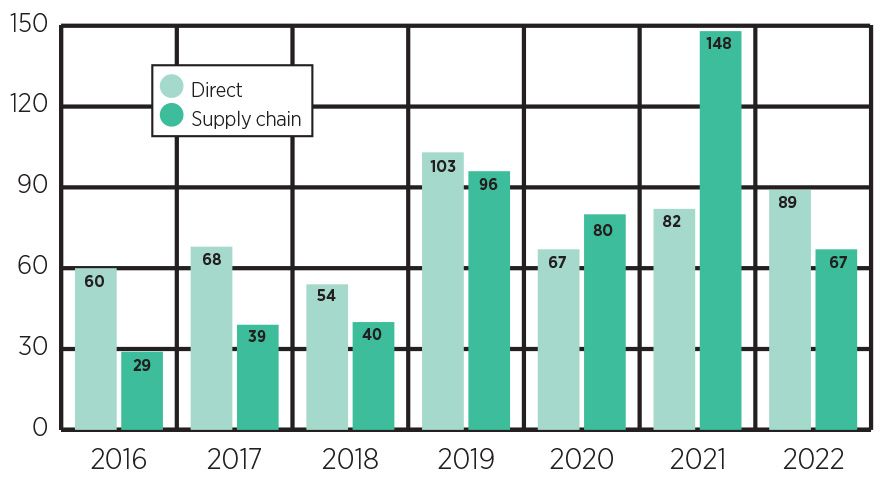

During the period between 2012 and 2023, 1,659 land use and biodiversity incidents were associated with supply chain management, and 776 pertained to direct operational involvement. While few incidents initially resulted in a high business impact and risk assessment, those that have tend to involve allegations of violations of indigenous rights or destruction of endangered species’ habitat.

Firms involved in land use and biodiversity incidents

The industries with the largest portion of direct involvement in negative land use and biodiversity incidents were paper & forestry (12%), oil & gas (9%) and industrial conglomerates (8%). Meanwhile, the industries with the largest portion of company involvement due to supply chain links are automobiles (8%), food retailers (7%) and textiles (6%).

However, among the industries highlighted in the report, the food products industry was specifically called out as having the highest average risk score (3.2), the largest range of risk scores (between 0.7 and 8.1) and the most outliers with regards to MEI in land use and biodiversity supply chain management.

According to the report, food retailers have been involved in a wide range of controversies over selling beef, chicken, soya, paper and palm oil products that have been linked to illegal land clearing and deforestation, as well as fish and fishmeal sourced from suppliers that are allegedly involved in unsustainable and destructive fishing practices.

Additionally, the report said that many companies in the food products industry seem unprepared to mitigate risks related to land use and biodiversity. 31% of the industry has no official deforestation policy, while 36% disclose a weak policy or only a general statement on the topic.

The world currently loses tree cover at an estimated rate of about 8,000 square metres – roughly the surface area of a football pitch – every second, despite the fact that deforestation is known to cause disruption to rivers and water systems, soil erosion and habitat destruction, as well as being associated with land grabbing, violence, corruption and other criminal activities.

Modelling different portfolio risk strategies

With several organisations, such as the Principles for Responsible Investment and the Taskforce on Nature-related Financial Disclosures, recently publishing recommendations for companies and investors to incorporate nature into their decision-making process, the Morningstar Sustainalytics team set out to model different portfolio strategies based on relevant ESG data points.

The portfolio models revealed that the Lower MEI Risk portfolio outperformed the Higher MEI Risk portfolio by more than 42 percentage points over a five-year period on a cumulative returns basis. The Long-Short portfolio, which Morningstar Sustainalytics developed to address growing market interest in incorporating ESG signals into alternative investments (including hedge funds), yielded a cumulative return of 65.6%, outperforming the Lower MEI Risk portfolio, the Higher MEI Risk portfolio and the market, as proxied by the Morningstar Global Consumer Sectors Index.