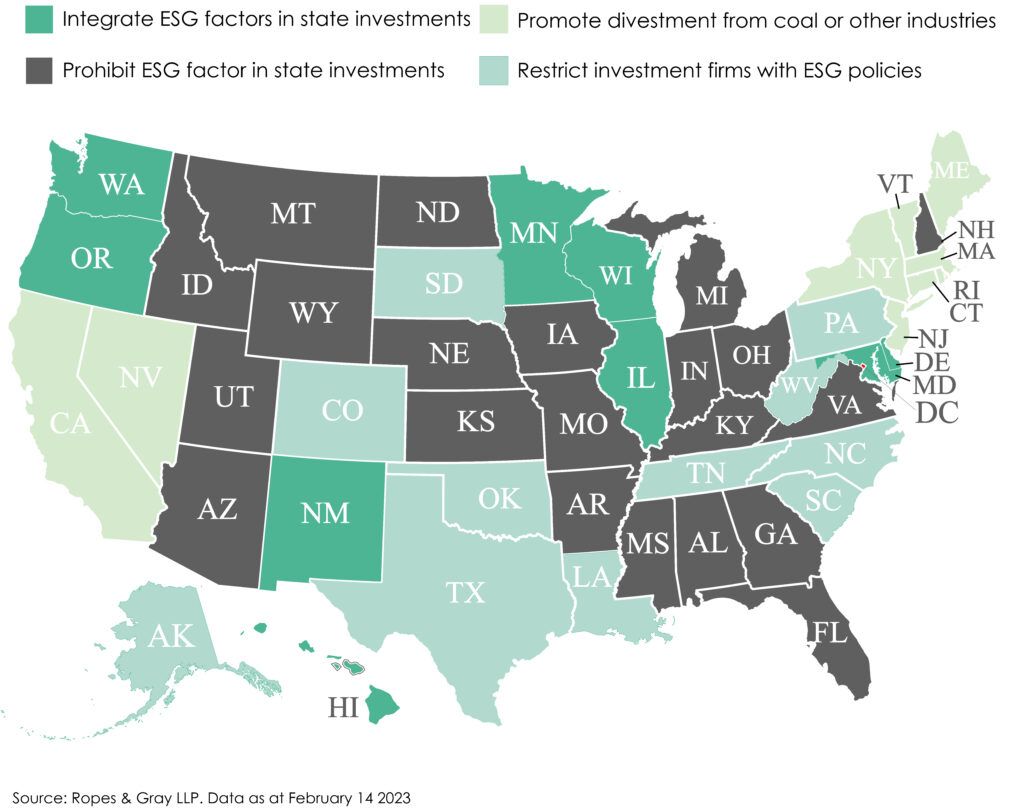

The ESG movement is deeply divisive in the US. Some states restrict investment firms with ESG policies, nearly half outright prohibit ESG as a factor in state investments.

Nonetheless, regulators are pushing ahead with new rules, albeit with some delays.

The US does not have a coherent, principles-based system of ESG regulation or established tools such as a taxonomy for sustainable activities or a Green Bond Standard akin to what is in place in Europe. However, the Securities and Exchange Commission (SEC) is proposing certain rules-based disclosure requirements that will impact companies, investment firms and investors.

Companies set to report climate risks this year

Listed companies will have to report climate-related risks that are “reasonably likely to have a material impact on their business, results of operations, or financial condition.” The securities regulator put out a proposal that would compel companies to include these disclosures in their registration statements and periodic reports. Large companies – publicly traded companies with a market cap above $700 million – will need to comply with the new rules later this year, smaller companies will have until 2025.

Companies will also need to report their greenhouse gas (GHG) emissions. This could be information about their direct GHG emissions (Scope 1), indirect emissions (Scope 2) as well as some GHG emissions from “upstream and downstream activities in its value chain” (Scope 3). A final rule is expected this month, but market practitioners anticipate that the SEC will leave out Scope 3. Sarah Bratton Hughes, head of sustainable investing at American Century Investments, said: “I wouldn’t be surprised if it was dropped.”

Environment aside, the SEC is expected to beef up existing rules on human capital disclosure, which compel companies to provide investors with information about their workforce – the ‘S’ in ESG. Bratton Hughes explained: “We’ve been waiting a while for human capital disclosure standards to come out. The expectation is that they may come out around June.”

Investment firms face tighter marketing rules around ESG

In January, the Financial Industry Regulation Authority (FINRA) cautioned broker-dealers against using misleading communications when promoting ESG funds. Leading law firm Clifford Chance advised firms to review their communications around those funds: “Given the heightened scrutiny those marketing ESG funds are facing from both politicians and investors, this is not a topic that will decrease in attention.”

The SEC is set to impose rules around how investment firms name and market ESG funds. Its existing ‘80% rule’ prohibits managers from giving their funds misleading names, and 80% of the fund has to be invested in the types of investments consistent with its name. The SEC is now proposing to apply this rule to ESG-related funds. Furthermore, so-called “integration funds” – which consider ESG along with, but not more significantly than, other factors – would be banned from using ESG or ESG-related terms in their names.

The SEC’s final ruling was expected to come out this month, but it is grappling with other rule-making such as whether to include Scope 3 emissions in companies’ climate-related reporting rules. The Supreme Court’s decision last year that the Environmental Protection Agency didn’t have the authority to regulate greenhouse gas emissions is a spanner in the works. Bratton Hughes said: “I’m not quite sure we’ll see it this month.”

States and Congress push back against ESG regulations

The anti-ESG movement is in full swing and some states have passed anti-ESG laws. Texas put 10 large financial institutions and 348 investment funds on its ESG boycott list, while Congress passed a bill to block the Department of Labour’s rule to allow plan fiduciaries to consider ESG factors when selecting investments, but President Biden vetoed it.

States may now fight the SEC. Bratton Hughes added: “Attorney generals in certain states could potentially challenge the SEC’s ruling. There is a possibility that that would happen.”