Assets under management sitting in ESG Ucits funds is on track to exceed €7.9trn by 2025, predicted PwC, despite fewer funds coming to the market.

In the fourth edition of PwC’s EU ESG Ucits poster supplements and updates to the data presented in the report 2022: The growth opportunity of the century, the firm said assets will continue to grow in Article 8 and 9 funds to comprise around 60% of the total Ucits AUM domiciled in the EU in less then two years’ time.

See also: – SFDR flip-flopping doesn’t inspire confidence despite ‘clarifications’

The number of ESG funds increased to 10,154 in the second half of 2022, carried by strong growth in the number of Article 8 funds, PwC said, which more than made up for the slight reduction in Article 9 funds.

The latter was a result of asset managers downgrading funds ahead of the introduction of the Sustainable Financial Disclosure Regulation (SFDR)’s Level 2’s regulatory technical standards (RTS) in Europe on 1 January 2023. This required fund providers to supply more detailed sustainability-related disclosure obligations, and complete mandatory reporting templates.

The industry has also seen fewer ESG funds being launched despite growth in AUM.

The update explained: “ESG AUM is following our projected growth trajectory. EU-domiciled Ucits ESG assets stood at €5.1trn as of H2 2022, of which 93.3% and 6.7% are classified as Article 8 and Article 9, respectively. This figure corresponds to 57% of total EU-domiciled Ucits AUM – a stark increase from 52% in the first half of 2022.

“However, most of this increase comes from existing funds that were newly reclassified as Article 8 or Article 9 funds. New funds represent only a small fraction of EU Ucits ESG assets (4.5%), although we expect this share to increase as newcomers gain steam.”

Despite the downgrades and decreased launch activity, PwC said SFDR has made the EU “the leading region for sustainable investing” but warned asset managers in the EU “will have to continuously adapt to the changing regulatory landscape”.

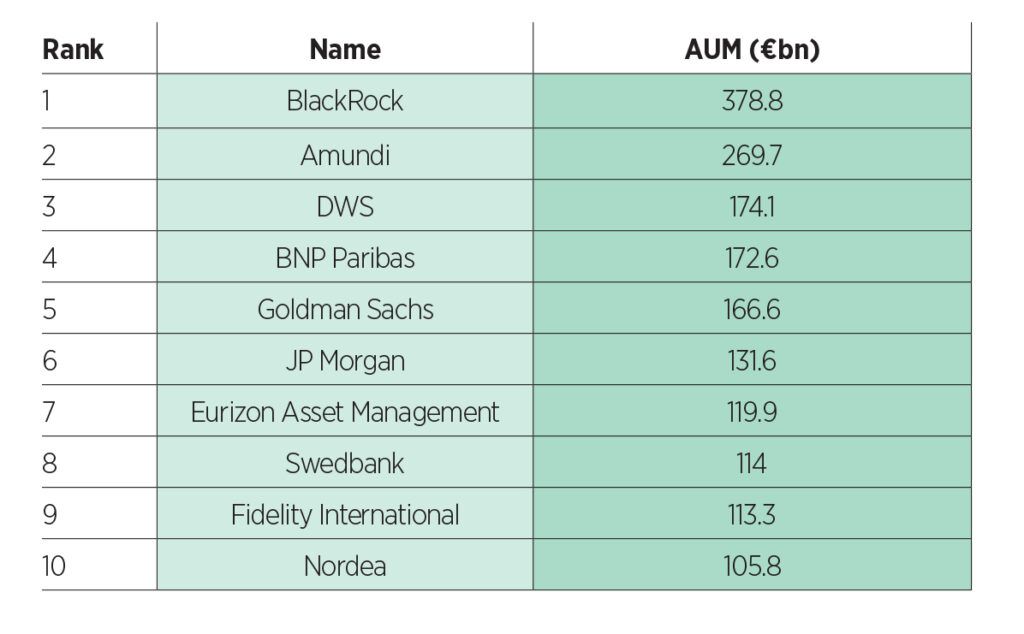

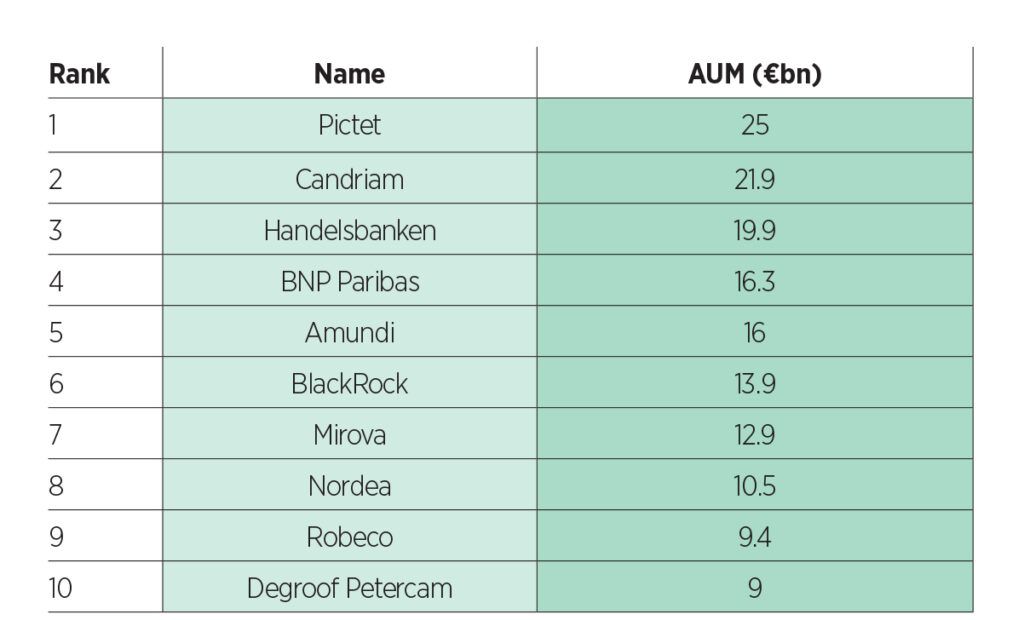

In its assessment, PwC also ranked asset managers by AUM in Article 8 and 9 funds.

Top 20 asset managers by Article 8 fund AUM

Top 20 asset managers by Article 9 fund AUM

While BlackRock and Amundi topped the Article 8 table, they only ranked sixth and fifth respectively for Article 9 funds. Looking at active vs passive split, a much higher number of assets are held in active funds – €4.3bn for Article 8 funds compared with €512m for passive, and €288bn was held in Article 9 active funds compared to €45bn in passives.

See also: – Passives’ Article 9 market share shrinks in Q4 shake-up