Question one: How does engagement in fixed income work in practice?

It’s a myth that engagement in the realm of fixed income is less effective than for equities. Our multi-decade experience of deep engagement with companies issuing debt illustrates this – and we have a solid track record that underlines how effective engagement can be in influencing company behaviour.

Our in-house stewardship team and engagers – including a global engagement team dedicated solely to fixed income – are a critical element of integrating ESG considerations into our investment process. Engagers and credit analysts work closely together; sharing views and opinions; and attending company meetings. This allows us to develop a much better real-time understanding of management’s thinking, culture and processes, as well providing an opportunity to encourage further progress on the path towards sustainability.

Question two: How do our strategies express their ESG convictions?1

Because we believe that non-fundamental factors are inexorably linked to credit risk, we typically integrate ESG factors into our investment decisions and assign ESG scores to all credits covered.

Our ESG assessment focuses on the impact that issuers’ ESG policies and behaviours have on cash flows and, thus, enterprise value.

In addition to the team’s ESG score, issuers that are taken through our Credit Committee are reviewed against the criteria of the investment teams’ proprietary sustainability scores, including sustainable development goals, Climate Change Impact and Sustainability Leaders.

These scores can provide the portfolio managers with further insight into the sustainable characteristics of a company when making investment decisions.

Proprietary scores integrated into research process

Source: Federated Hermes Limited, 14 August 2023

Question three: What is a QESG score?

We believe that improved ESG behaviours lead to lower risks and volatility and thus better investment decisions. To achieve a fuller understanding of those behaviours, our investment teams use their own proprietary quantitative ESG (QESG) scores as one of several inputs into their analysis.

These QESG scores combine internal analysis with external sources, such as Sustainalytics, MSCI and Trucost to score company’s behaviours.

Federated Hermes’ firmwide proprietary ESG dashboard is also integrated into our ESG assessments. In addition, analysts have access to our proprietary firmwide Carbon Tool, allowing them to assess a company’s carbon footprint and our Climate Change Database, allowing access to climate and sustainability-related information of the credit universe. These tools allow for sophisticated comparison of companies against peers and sectors with respect to a wide range of ESG considerations.

Question four: What’s with the ESG-risk curve?2

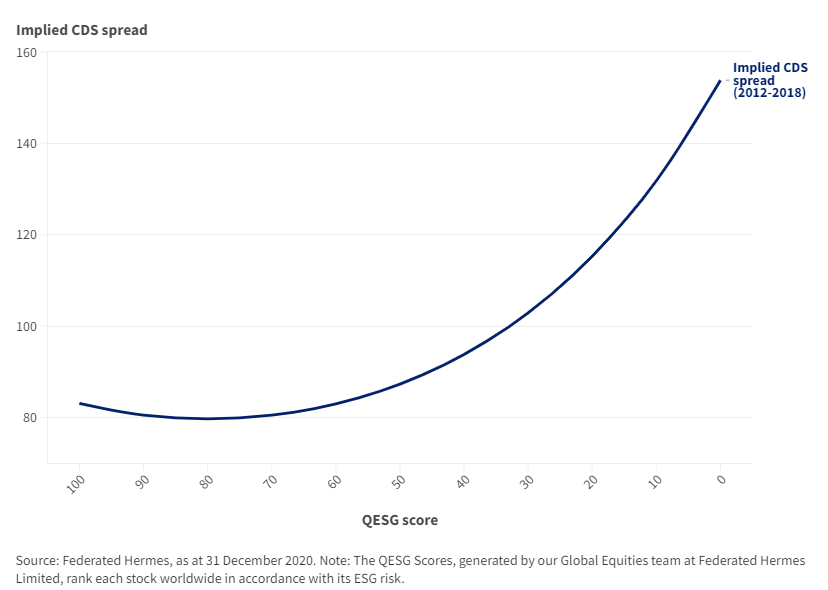

In 2017 as part of an effort to analyse credit risks with greater precision, Federated Hermes developed a pricing model to capture the influence of environmental, social and governance (ESG) factors on credit spreads.

We presented the results of that analysis in our pioneering paper ‘Pricing ESG in Credit Markets’, in which we demonstrated that companies with better environmental, social and governance (ESG) practices tended to have lower credit default swap (CDS) spreads, even after controlling for credit ratings. Using the results, we plotted predictions of CDS spreads for given values of ESG scores, drawing an innovative implied ESG pricing curve. In 2018 we published an updated study with a longer sample period which produced similar results. In 2021 we completed a third study, expanding the sample period to include the period from the start of 2012 to the end of a volatile 2020, the results of which are published here.

All of this research shows that, even when controlling for operating and financial risks (measured by credit ratings), as ESG factors deteriorate, credit spreads widen. Because the reverse is also true, this relationship has significant investment implications. Figure 1 shows the implied ESG pricing curve using the full dataset from 2012 to 2020. Our results suggest that credit markets are likely to reward companies that make the transition from ESG laggards to leaders with tighter CDS spreads.

Figure 1: Implied CDS spreads and corresponding QESG scores, 2012-2020

Question five: Can ESG factors also affect the pricing of government debt?

As highlighted in our previous question, our robust ESG-CDS pricing model proves there is a relevant correlation between CDS spreads and ESG risk factors in credit markets. This observation is particularly poignant given that asset owners and fund managers are increasingly looking to ‘screen in’ companies seen as ESG and sustainability leaders to reinforce the ESG credentials of their portfolios.

In 2020 we published research which added weight to the argument, illustrating that the correlation between environmental, social and governance (ESG) scores and CDS spreads goes beyond just credit markets but also to government debt too, particularly in developed markets. Long story short: the higher the ESG credentials the lower the (implied) cost of capital.

Disclaimer:

The value of investments and income from them may go down as well as up, and you may not get back the original amount invested.

These strategies have environmental and/or social characteristics and so may perform differently to other strategies, as its exposures reflect its sustainability criteria.

For professional investors only. The views and opinions contained herein are those of the author and may not necessarily represent views expressed or reflected in other communications. This does not constitute a solicitation or offer to any person to buy or sell any related securities or financial instruments.

Issued and approved by Hermes Investment Management Limited which is authorised and regulated by the Financial Conduct Authority. Registered address: Sixth Floor, 150 Cheapside, London EC2V 6ET.

Distributed in Singapore by Hermes GPE (Singapore) Pte. Ltd which is regulated by the Monetary Authority of Singapore.