UK retail investors’ exposure to sustainable funds has steadily increased since 2020, according to data from interactive investor, despite the upturn remaining volatile over shorter-term time frames.

In 2023 to the end of August, retail investors have allocated 2.4% of their overall portfolios to sustainable investments, compared to 2.2% in 2022, 2% in 2021 and 1.6% in 2020.

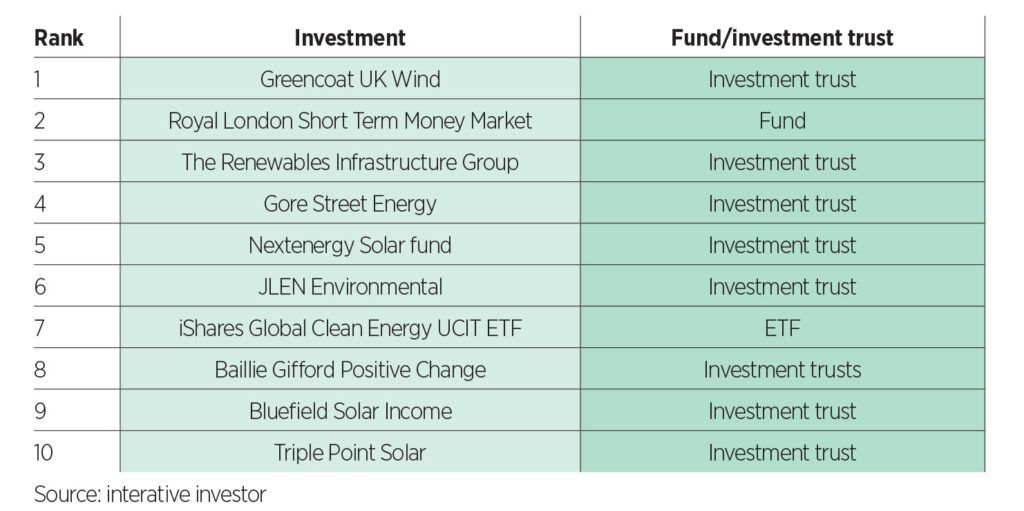

The funds proving most popular year to date on ii’s Sustainable Investment Long List include the Greencoat UK Wind trust, the Royal London Short Term Money Market fund, and the Renewables Infrastructure Group trust.

Investors have also been allocating their capital to the likes of Gore Street Energy, NextEnergy Solar Fund and JLEN Environmental. The most popular ETF from the list year to date has been iShares Global Clean Energy UCITS ETF.

Dzmitry Lipski, head of fund research at interactive investor, said: “It is fascinating to see that ii customers are not necessarily being put off by shaky short-term returns for sustainable investments, and if they choose to, are continuing to align their money with their ethical/sustainable values.”

He added there are a few challenges facing sustainability funds, namely the current investment landscape, and ensuring that funds are as environmentally friendly as they present themselves to be.

“Nonetheless, the wider mainstream adoption of sustainable investing – or ESG integration – across investment strategies provides a positive long-term outlook for the sustainable universe,” Lipski continued.

“Sustainable investment/ESG matters are being increasingly embedded across both company practices and investment strategies, as growing evidence shows that companies more aligned to environmental, social and governance considerations can produce better risk-adjusted, sustainable returns.”

Gender and age divides

Younger investors and women have been leading the charge on sustainable investment exposure this year, according to ii.

In particular, investors aged 25-34 have bought into sustainability-focused mandates, with 3.2% of their portfolios dedicated to the investments. Those in the 35-44 and 45-54 age brackets are just behind with 2.9% exposure respectively. While the 65+ age group by far holds the least at 2%, this still outpaces where the 25-34 age group began just four years ago in 2020 and has experienced consistent growth.

See also: – Interested but sceptical: What younger investors think about ESG

Women continue to hold greater exposure to sustainable-focused funds as well this year, a trend which has continued since 2020. As of 31 August, women hold 2.6% exposure while men hold 2.4%.

“This gradual increased exposure, particularly among women and the younger cohort on the platform, mirrors wider industry sentiment that sustainable investing is more than just a ‘fad’,” Lipski said.

“Sustainable investing has the potential to offer investors exposure to companies with more resilient business practices, risk-adjusted returns, and those best placed to contribute to and benefit from a more sustainable future.”

Lipski said he will be looking for the FCA’s Sustainable Disclosure Requirements and Labelling Regime that is set to be published later this year, which he hopes will provide a clearer picture of what being a sustainable fund truly entails, clearing up uncertainty for investors.

This article first appeared on ESG Clarity’s sister title Portfolio Adviser.