Inflows into global sustainable funds continued to slow in the second quarter of 2023, but this compared to marked outflows in the conventional universe amid a challenging market backdrop, according to Morningstar.

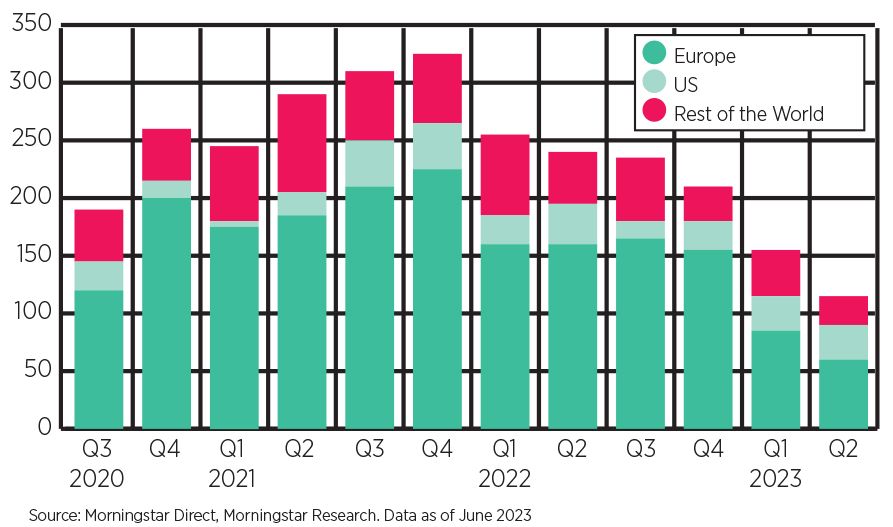

In the Global Sustainable Fund Flows: Q2 2023 in Review, Morningstar said global sustainable funds attracted $18bn in net new money during the quarter, lower than the $31bn seen in Q1 with the report citing “sticky inflation, rising interest rates and recession fears” as reasons for why investors are pulling their cash from funds.

In contrast, the overall global fund universe returned to outflows in Q2 with $37bn exiting amid the continued challenging macro backdrop. In Q1 the wider universe saw inflows of $77bn.

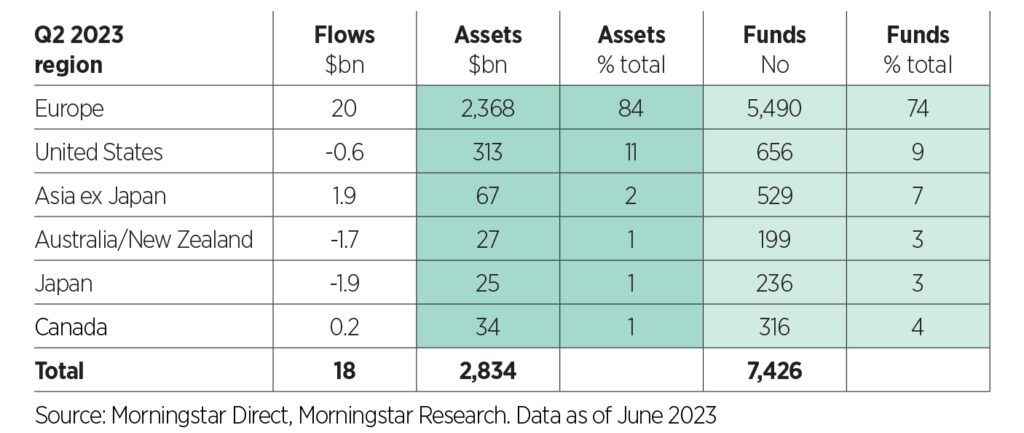

Global sustainable fund statistics

The decelerated growth in sustainable funds inflows was seen across the regions analysed by Morningstar, however, assets under management are slowly climbing back towards historic highs – AUM hit nearly $2.8trn at the end of June, closer to the record level of $3trn seen at the end of 2021.

Product development also continued to slow with an estimated 106 new products coming to market – the number of fresh offerings in Europe drove this decline with a slump of almost 28% since Q1. However, Morningstar said product development in the US continued its momentum.

Global sustainable fund launches per quarter

Hortense Bioy (pictured), global director of sustainability research at Morningstar and member of the ESG Clarity Committee, said: “The second quarter saw reduced inflows as a result of the continuously challenging macro backdrop…[but] ESG funds continued to hold up better than the rest of the market, which saw net outflows. Climate remained the most popular sustainability theme among new product launches, both in Europe and the US.”

Asia

Excluding China, the Asia ex-Japan region saw inflows of $172m into sustainable funds in Q2, driven by Taiwan-domiciled funds which saw inflows of $307m.

South Korea-domiciled funds saw inflows of $20m bucking a trend of outflows over the previous consecutive four quarters.

Total assets in sustainable funds across Asia ex-Japan remained relatively flat, growing by just 0.5% since the end of March.

Japan also saw outflows in Q2 with $1.9bn exiting sustainable funds. This is nearly double the previous record low set in the first quarter of 2023, and Q2’s retreat also marks the fourth-consecutive quarter of net outflows from sustainable funds.

Active funds accounted for 90% of the outflows. Total assets in Japan’s sustainable fund universe slid to $24.9bn.

In Australia and New Zealand, sustainable funds bled $1.66bn, which Morningstar said was a direct result of Vanguard’s strategy to withdraw from segregated mandates and to scale back from the institutional investor segment to focus on individual investors.

This also affected AUM which were down by more than $3.7bn to $27.5bn.

Europe

Europe is “by far the most developed and diverse ESG market” and continued to take the lion’s share of the sustainable fund landscape, with 84% of global sustainable fund assets, said the report.

However, after rebounding toward the end of 2022, net new money into European sustainable funds “extended its deceleration into the second quarter of 2023” and inflows reached just over $20bn from the readjusted $33.7bn in the first quarter. Passive strategies captured over three fourths (82%) of the net new capital and the top 10 best selling funds were all passives with the Goldman Sachs Enhanced Index Sustainable Global Equity Fund topping the leaderboards at $3.6bn in inflows.

Bioy noted: “In Europe, ESG funds attracted net new money despite a slowdown in product development, greenwashing concerns and the ever-evolving regulatory environment.”

See also: – Sustainable funds see further outflows in Q1

Equity funds were the most favoured asset class, garnering $13.4bn for the quarter, and while lower than Q1, it is in “striking contrast” with the $28.3bn pulled from conventional equity funds.

Sustainable bonds funds pocketed $8.8bn, down by almost a third compared to the previous quarter. “Although central banks are still on tightening mode, investors are already betting on a peak to rates and are shifting the focus from the short to the mid-to-long area of the yield curve to pre-empt a change of cycle toward a period of stability in interest rates and ultimately lower ones in the longer run,” the report noted.

BlackRock, DWS, Swisscanto, abrdn and JPMorgan were the top five providers by flows in Q2, while Royal London, Credit Suisse, Pictet and UBS were the bottom providers by flows.

Similar to the global sustainable fund stats, European sustainable fund assets are edging back towards historical highs and stood at $2.4trn at the end of June.

US

Negative sentiment towards ESG strategies in the US was reflected in Q2 data with $635m pulled from sustainable funds – however, this was less than the $5bn+ losses seen in the previous two quarters. With a third consecutive quarter of outflows, investors have withdrawn $11.4bn from US sustainable funds over the past year.

Passive funds were more popular but still saw outflows of $100m in Q2, while active funds saw $528m exiting.

Some of the newest passive funds were popular with investors: “Passive fund providers BlackRock and DWS both launched climate-focused ETFs during the second quarter, and they quickly catapulted to the top two spots in terms of second-quarter flows. iShares Climate Conscious & Transition MSCI USA ETF USCL and Xtrackers MSCI USA Climate Action Equity ETF track indexes that lean into companies that are well-positioned for the transition to a low-carbon economy or that are actively engaging in the climate transition, relative to peers.”

Assets in US sustainable funds rose to $313bn in the quarter, their highest point since Q1 2022.