BlackRock, Invesco and Vanguard are among the biggest investors backing the largest fossil fuel bonds in 2023, according to research by Reclaim Finance.

Using Bloomberg data as at September 2023, the NGO tracked new bonds issued this year by some of the biggest fossil fuel developers to raise capital. In total, 40 bond packages were analysed issued by 13 fossil fuel companies that helped raise a total of $45bn on the bond market over the course of 2023. Then Reclaim Finance looked into which financial institutions were involved in backing the bonds – it found more than 100 banks were involved in the structuring of at least one of the fossil fuel bonds, and several dozens of investors currently hold at least one of the bonds.

See also: – GFANZ transition finance measurement ‘fatally flawed’ NGOs claim

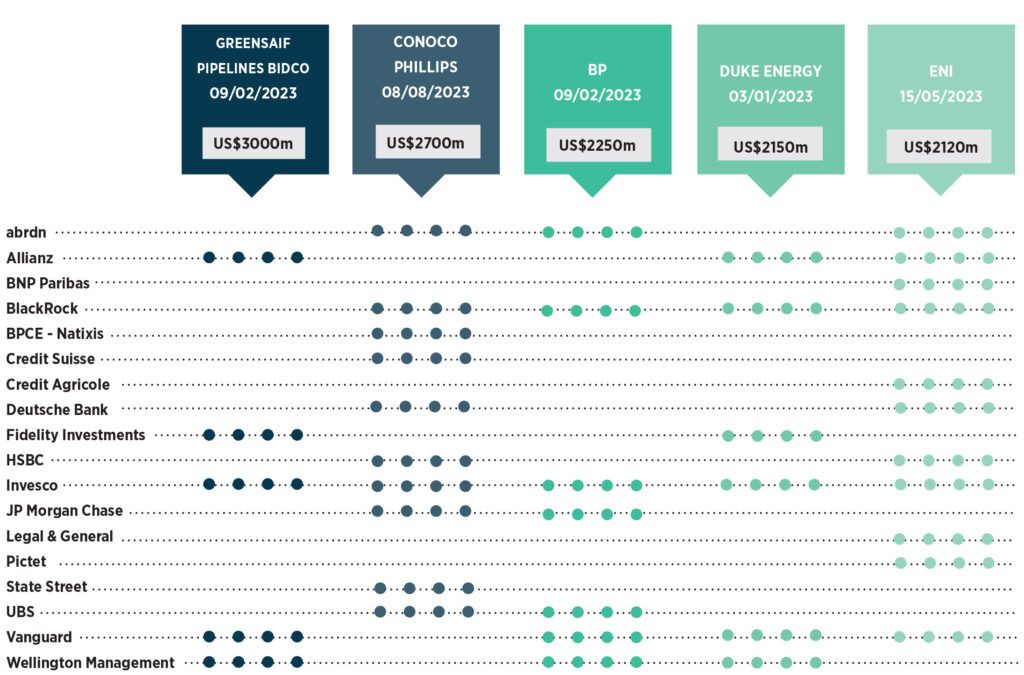

The five biggest fossil fuel bonds were issued by BP ($2.25 bill), ConocoPhillips ($2.7 bill), Duke Energy ($2.150 bill), Eni ($2.12 bill) and Greensaif Pipelines Bidco – linked to Saudi Aramco ($3 bill), and collectively raised more than $12bn for the oil and gas giants. Reclaim Finance said many of these deals have also been immersed in controversy, including ConocoPhillips’ crossing tar sands exclusion thresholds and Saudi Aramco via Greensaif and other companies tapping money meant for sustainable investments.

The investors behind the ‘worst’ fossil fuel bonds in 2023

The BP bond was held by Abrdn, BlackRock, Invesco, JP Morgan Chase, UBS, Vanguard and Wellington Management, according to the research.

Meanwhile, the Conoco Philips bond was backed again by Abrdn, BlackRock, Invesco and UBS, and also Natixis and Credit Suisse among others.

The research also claimed these bonds were being held in portfolios marketed as sustainable offerings. The report The Worst Fossil Fuel Bonds in 2023 said: “These cases show that many investors with net-zero commitments are granting new money to fossil fuel developers. But worse still, this money sometimes comes from funds that are presented as sustainable by these investors. For example, a Bloomberg investigation revealed that some of these new fossil fuel bonds – issued by Greensaif Pipelines, an entity linked to Saudi Aramco – ended up in ESG funds from asset managers like UBS Asset Management, Legal & General Investment Management and HSBC Asset Management.

“As another example, part of the Eni bond shown above was sold to investors as a ‘sustainability-linked bond’ despite Eni being one of the biggest fossil fuel developers in Europe.”

Banks

The report also echoed concerns robust policies are not in place to stop banks supporting fossil fuel companies. “In the banking sector, oil and gas bonds are a huge blind spot of climate policies,” it said. “While a dozen big banks have today stopped facilitating issuances of bonds for all or many coal developers, only two have stopped for oil and gas developers (La Banque Postale and Danske Bank).

“This reveals a general lack of robust policies restricting corporate financial services for the oil and gas sector. Several major banks have committed to restrict project-level financing in the sector, including stopping the structuring of bonds dedicated to some fossil fuel projects. But the vast majority of these banks’ policies ignore financial services for general purposes, including the structuring of bonds for general corporate purposes.”

ESG Clarity has contacted asset managers for comment.