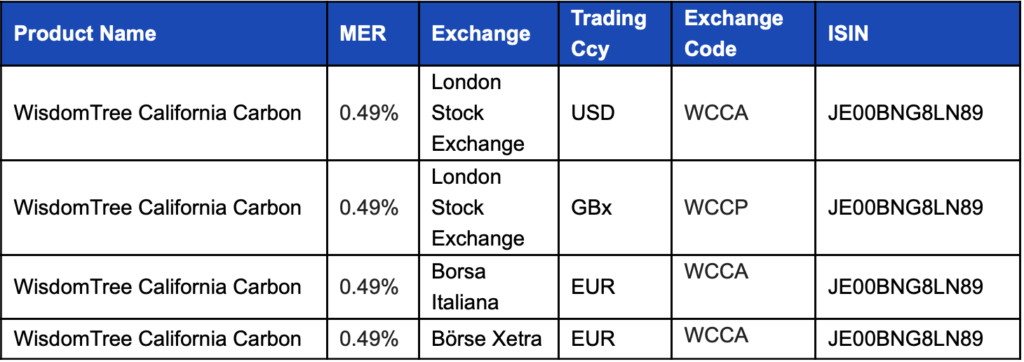

The fully collateralized WisdomTree California Carbon ETP (WCCA) is now listed on the London Stock Exchange, Borsa Italiana and Germany’s Börse Xetra, with a management expense ratio of 0.49%.

The New York-based exchange-traded fund provider’s newest exchange-traded product allows European investors to bet on the success of California’s carbon credit system.

California’s Air Resources Board issues carbon allowances as part of its “cap-and-trade” emissions trading set-up, a markets-based system aimed at cutting global greenhouse gas emissions and slowing climate change. The market has been one of the fastest growing and is the second most liquid carbon allowance market globally; its futures traded around $1.7bn per month last year.

The WCCA tracks the price movement of ICE California Carbon Allowance Futures through the Solactive California Carbon Rolling Futures TR Index. It complements the $287m WisdomTree Carbon (CARB), a fully collateralized ETP providing exposure to EU carbon allowances.

Reducing emissions to net zero is an increasingly important focus for policymakers around the world. California’s scheme is the first of its kind in North America, designed to help the state achieve its new target of slashing greenhouse gas emissions by 85% below 1990 levels by 2045.

Alexis Marinof (pictured), head of Europe at WisdomTree, said: “It is, therefore, imperative that investors have access to a wide spectrum of exposures. WCCA removes many of the barriers investors face when allocating to this asset class and builds on WisdomTree’s heritage of bringing hard-to-access exposures to investors through ETPs.

“We are building a range of differentiated and complementary ETPs that allow investors to participate in the energy transition through thematic equities, commodities, or carbon allowances.”

Carbon credits show potential for environmental impact but people should think twice before using them as strategic investments, cautioned Morningstar. In a report published last year, it found that it is virtually impossible to peg the future financial costs to society of burning carbon today, in order to set caps. It also found little correlation between the nascent carbon credits market and energy prices moves.