Women in the UK are predicted to make £10,362 less on their investments than men by 2030 if they invest 7.5% of their earnings, according to a new study by Shepherds Friendly.

The average salary for a woman in the UK is £28,765 while men typically make £41,850 — a difference of over £13,000 a year.

By investing 7.5% of those savings over the coming years, the £22,780 total value women are expected to accumulate by 2030 is almost a third (31.3%) lower than the £33,142 in the average man’s savings pot.

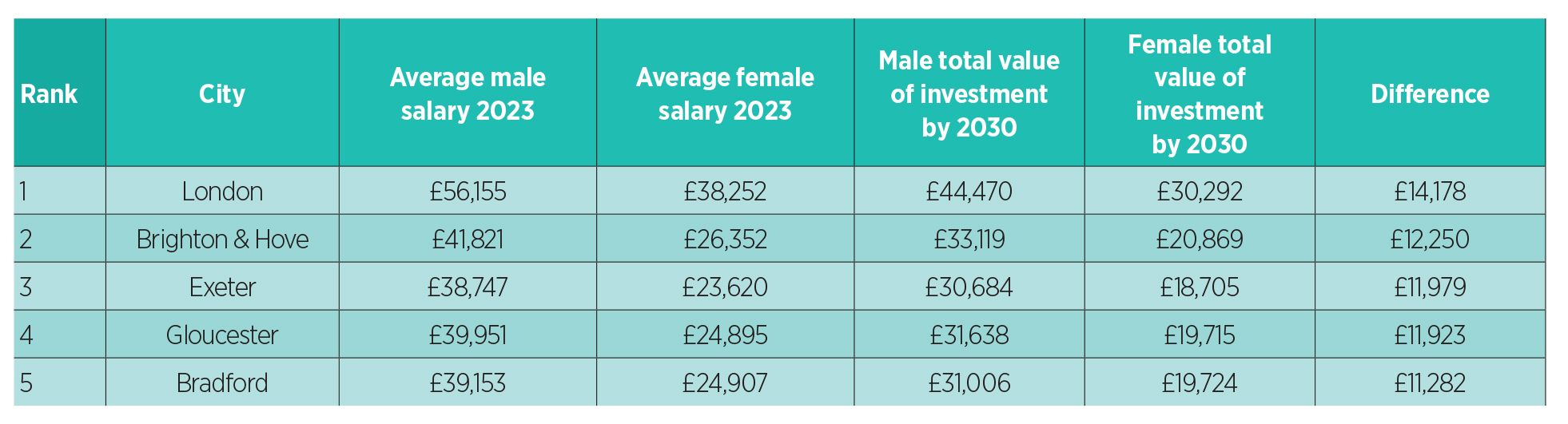

And that is just the country average – in some areas that dispersion is much wider. London has the largest gender wage gap in the country, with women in the capital earning £17,903 less than men on average.

By investing that money over the long term, women in London are expected to be £14,178 worse off in their savings pot than men by 2030.

UK cities with the biggest gender investment gap in 2023

The same can be said for Brighton & Hove and Exeter, with women working in both areas forecast to have £12,250 and £11,979 less in their savings pots respectively than men over the period.

Salary differences between women (£27,126) and men (£29,439) in Dundee are the smallest in the UK, but the savings of female investors are still forecast to be £1,832 lower by 2030.

See also: – Diversity Project expands Pathway programme as women fund managers share success stories

Derence Lee, chief finance officer at Shepherds Friendly, said: “How much you can afford to set aside for investing will depend on your financial circumstances, however, it’s interesting to see how the gender pay gap may be causing discrepancies when it comes to what female investors can earn.”

UK cities with the smallest gender investment gap in 2023

The gender pay gap may play a big part in this anticipated divergence in savings over the long term, but Lee added that the fact women are less confident when it come to investing does not help.

He highlighted a study by Nerd Wallet which revealed that less than half (48%) of women are invested in stocks while most men (66%) are.

Shepherds Friendly also found in its own study last year that two in five men (39%) feel confident in their knowledge of investing versus a quarter of women. Indeed, 45% of women the firm spoke to said they thought investing was too risky for them.

Lee added: “While there is always a certain degree of risk involved with investing, it’s still a great way for both men and women to potentially secure greater financial stability and freedom for themselves in the future.”

This article first appeared on ESG Clarity’s sister title Portfolio Adviser.